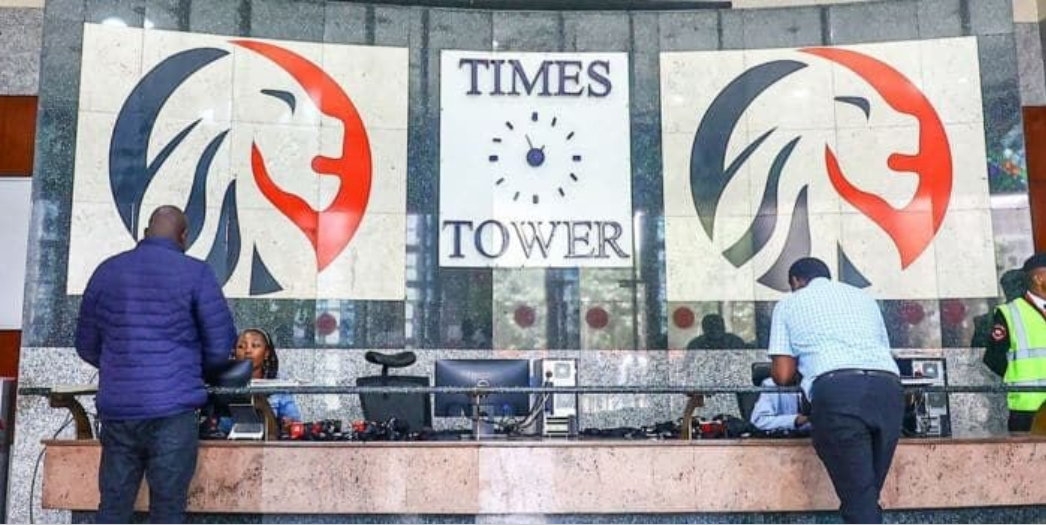

Filing taxes no longer needs a computer, cybercafé, or long queues at KRA offices. The Kenya Revenue Authority has rolled out a WhatsApp chatbot that allows taxpayers to access key services directly from their phones.

This new system marks a major shift in how Kenyans interact with KRA. It saves time, cuts costs, and removes barriers linked to internet access and digital skills. This guide explains how to file your KRA taxes via WhatsApp and why the service is a game-changer for millions of taxpayers.

Step-by-Step on How to File Your KRA Taxes via WhatsApp

KRA designed the WhatsApp chatbot to simplify tax services and make them available at any time. The service runs 24 hours a day and supports 15 core tax functions, including tax filing.

To get started, save the official KRA WhatsApp number +254 711099999, on your phone. Open WhatsApp and send a simple message such as “Hi” or “Menu.” The chatbot responds instantly.

The system then asks you to verify your identity. This step protects your tax data and ensures only authorised users access personal information. Once verification is complete, the chatbot displays a menu of services you can use.

When you select tax filing, the bot guides you through the process in clear, simple steps. It explains what type of return you need to file and what details you must provide. The chatbot does not replace iTax but works as a smart assistant that walks you through filing your return correctly on the iTax portal.

KRA Commissioner General Humphrey Wattaga confirmed that the goal is convenience. He explained that taxpayers can file returns both via WhatsApp guidance and through the web, without visiting KRA offices. This approach reduces errors, saves time, and improves compliance.

Services You Can Access Through the KRA WhatsApp Bot

Tax Filing and Return Assistance

The WhatsApp chatbot focuses heavily on tax filing support. It gives step-by-step instructions for filing returns, whether you are an employee, business owner, or landlord. The bot explains filing deadlines, required documents, and common mistakes to avoid.

Taxpayers also receive guidance on nil returns, which many Kenyans struggle to file correctly. By following the prompts, users reduce the risk of penalties caused by late or incorrect submissions.

This feature especially helps first-time taxpayers and small traders who find the iTax platform confusing.

PIN Management and Digital Self Service

Beyond filing returns, the chatbot supports PIN registration and PIN updates. Users can also ask tax-related questions and receive instant answers without waiting for customer care support.

The service integrates with eTIMS invoicing, making it easier for traders to comply with electronic invoicing rules. Users can also access digital self se-servicetions that reduce paperwork and manual processes.

KRA Chairman Ndindi Muriithi noted that modmodernizing systems improves efficiency and boosts revenue collection. He linked the digital shift to KRA’s ambitious revenue target of Kshs 2.968 trillion for the 2025/26 financial year.

Why WhatsApp and USSD Mark a Turning Point for Taxpayers

KRA understands that not every Kenyan owns a smartphone or enjoys stable internet access. That reality pushed the authority to expand beyond web-based platforms.

Two weeks before launching the WhatsApp chatbot, KRA introduced a USSD service accessible by dialing *222#. This service works on basic mobile phones and offers PIN registration, turnover tax, monthly rental income, payments, tax compliance certificates, customs services, and other returns.

The authority admitted that digital access remains a major challenge for many taxpayers. By offering both WhatsApp and USSD options, KRA ensures inclusivity and wider compliance.

Together, these tools reduce congestion at KRA offices, cut operational costs, and empower taxpayers to manage their obligations with ease.