Kenya is once again under international scrutiny. This time, it is over the growing threat of money laundering. President William Ruto has fired back after the European Union placed Kenya on a new list of high-risk countries failing to curb financial crimes.

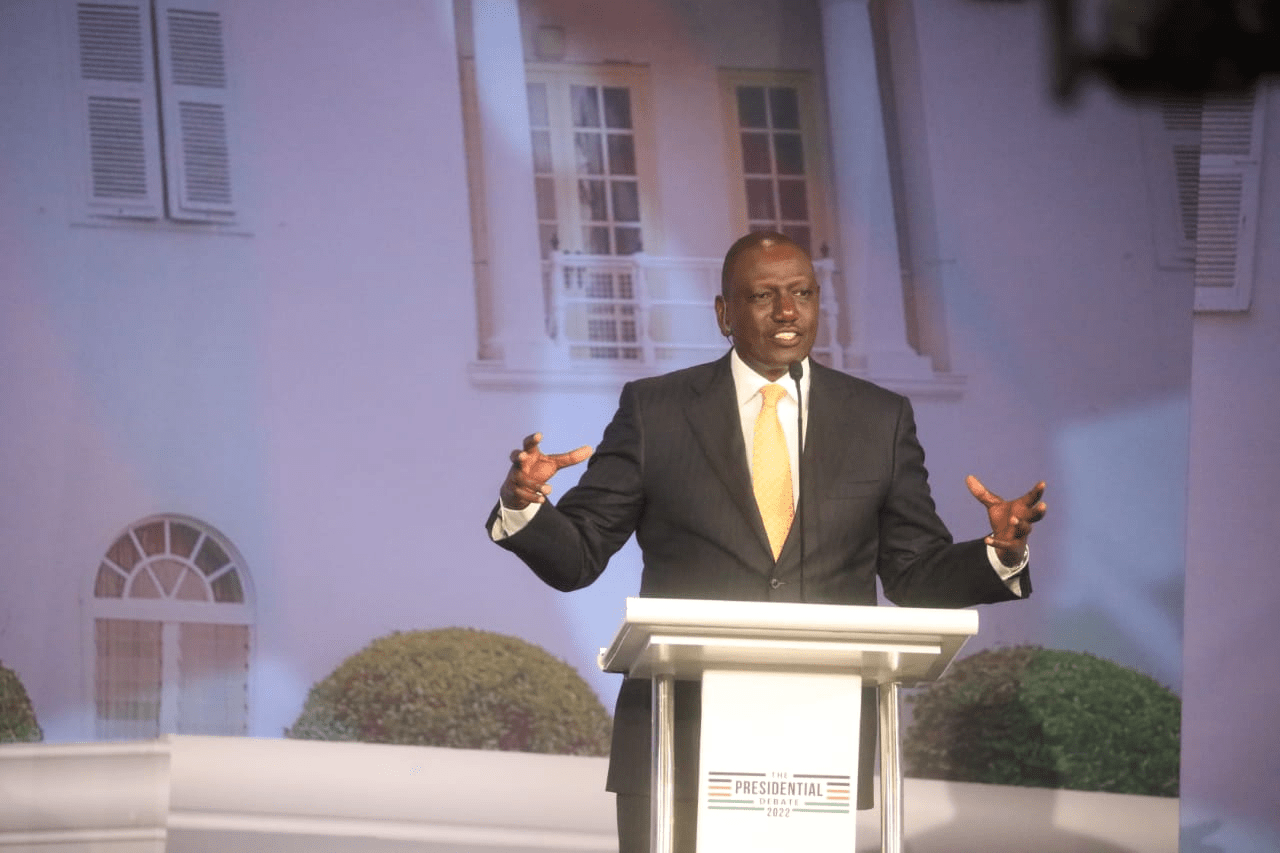

The move has rattled investors and watchdogs, but Ruto insists the country is not sitting idle. During a high-profile prosecutors’ meeting in Mombasa, the president pledged sweeping reforms, more funding, and a revamped legal framework to fight money laundering in Kenya. But critics are asking, is it too little, too late?

Ruto Announces New Funding and Reforms to Fight Money Laundering in Kenya

President William Ruto admitted that money laundering in Kenya is a serious concern, but promised immediate action. Speaking during the closing ceremony of the Commonwealth Heads of Prosecuting Agencies Conference in Mombasa on Thursday, June 12, he made it clear that Kenya was taking the issue seriously.

“We are committed to strengthening our institutions and improving the quality of investigations,” Ruto said. He pledged more money to agencies such as the Office of the Director of Public Prosecutions (ODPP), Directorate of Criminal Investigations (DCI), and Financial Reporting Centre (FRC). According to him, fighting organised crime, money laundering, and terrorism financing will now receive top government priority.

“We will fully support the empowerment and funding of the ODPP,” he said. “Revamping our anti-money laundering and asset forfeiture framework is a testament to our commitment.”

His comments come just a day after the European Commission listed Kenya among high-risk countries with weak anti-money laundering and counter-terrorism regimes. Others on the list include Algeria, Angola, Nepal, and Venezuela.

Being listed means Kenya is now under extra monitoring by financial institutions in Europe and beyond. This affects the country’s ability to attract foreign investors and secure financial partnerships.

EU Watchlist Raises Global Concerns Over Kenya’s Financial Integrity

The European Commission’s move to list Kenya was based on strategic deficiencies in the country’s anti-money laundering (AML) and counter-terrorist financing systems.

In their official statement, the Commission cited Kenya’s lack of strong controls, enforcement gaps, and rising suspicion around unexplained financial transactions. The inclusion in the high-risk jurisdictions list sends a clear warning: fix your house or face economic isolation.

The Financial Action Task Force (FATF), a global body based in Paris, had earlier grey-listed Kenya, prompting fears of regulatory backlash. FATF monitors over 200 countries and jurisdictions, ensuring financial systems are not used to hide or transfer proceeds of crime.

For Kenya, the new label may lead to stricter checks on international money transfers, delays in processing transactions, and increased scrutiny from global banks.

But the bigger concern lies within. According to the Financial Reporting Centre (FRC), there has been a surge in suspicious cash movements across local banks, insurance firms, forex bureaus, and SACCOs. FRC has responded by stepping up real-time transaction monitoring and demanding enhanced due diligence from reporting institutions.

DCI and Prosecutors Tighten Grip on Illicit Financial Flows

Kenya’s Director of Investigations Bureau at DCI Headquarters, Abdalla Komesha, issued a firm response. He said his team had already intensified probes into money laundering networks, terrorism financing cells, and their links to organized crime.

“We are not just tracking paper trails. We are going after the criminals behind them,” Komesha said during a press briefing in Nairobi.

He added that joint operations involving local and international agencies are ongoing, especially targeting financial cartels suspected of moving dirty money through Nairobi’s banking system.

Meanwhile, top prosecutors attending the Mombasa conference issued a joint resolution calling for stronger legal tools, better international cooperation, and the full implementation of asset recovery laws. Kenya, they said, must stop being a safe haven for dirty money.

President Ruto agreed. “This conference has shown us the threats are real and evolving,” he told the delegation. “We will not hesitate to act.”