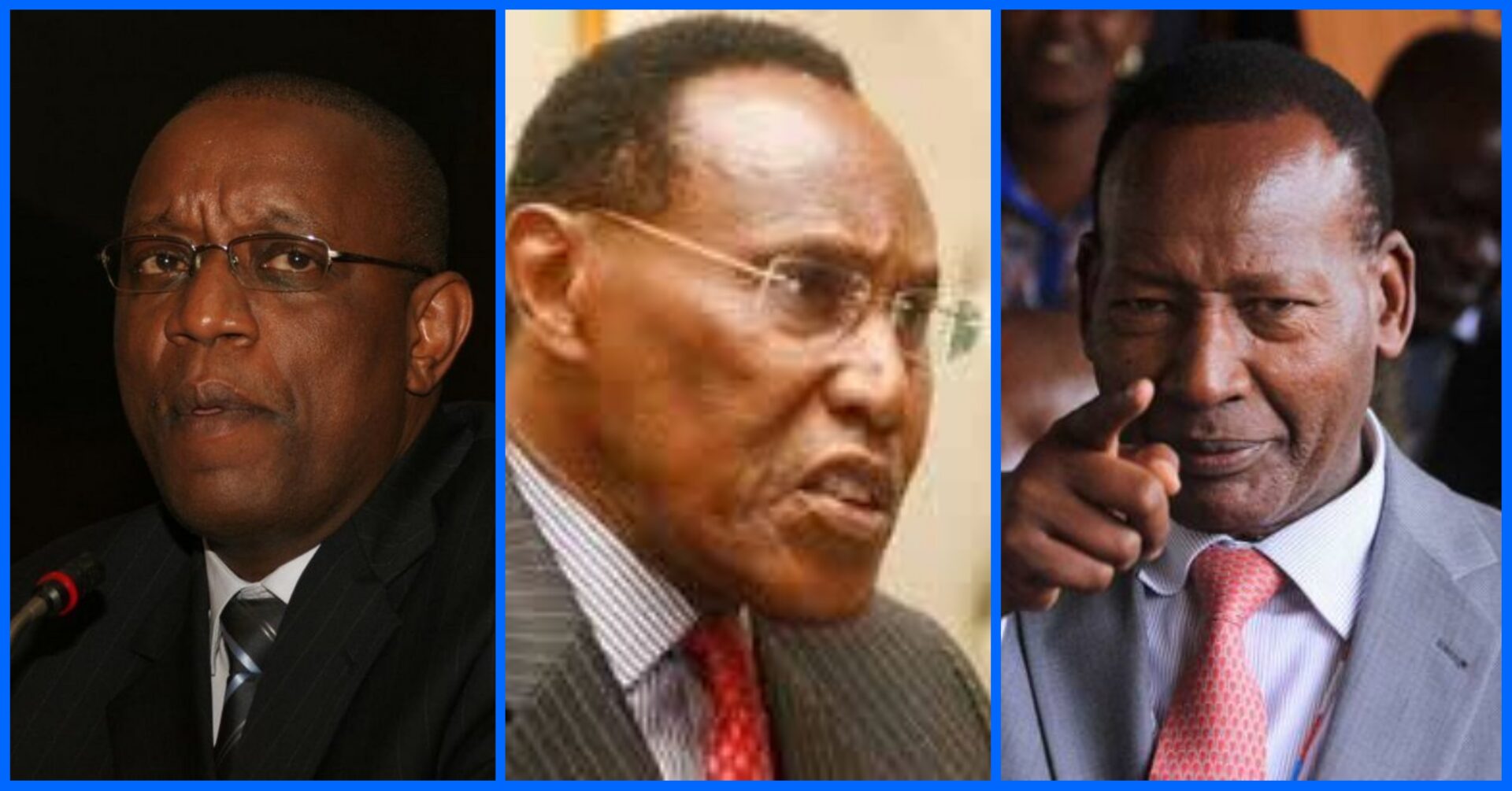

Kenya’s 2025/26 Budget Date Announced

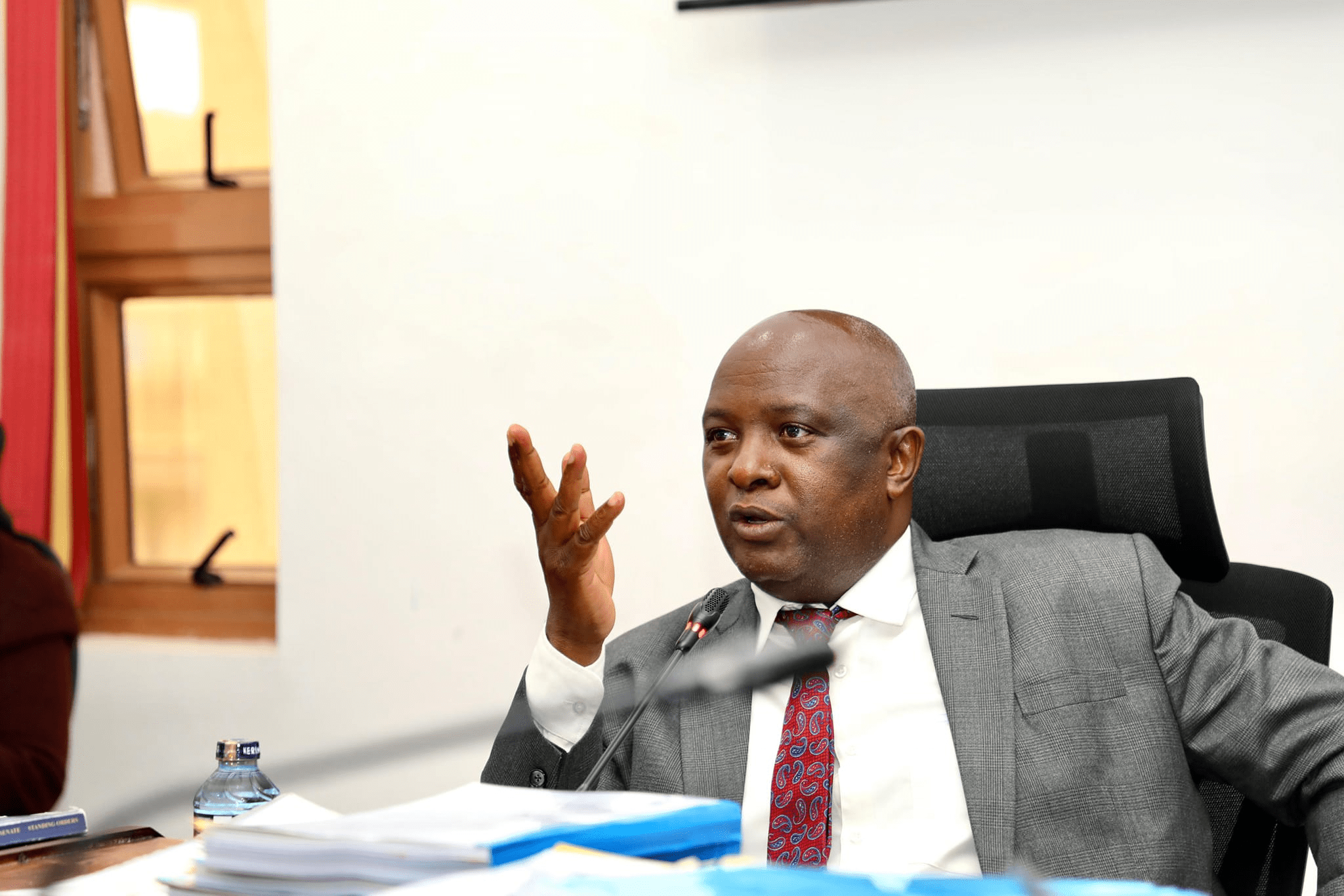

The National Treasury has confirmed that Cabinet Secretary John Mbadi will officially present the national budget for the 2025/2026 fiscal year on Thursday, June 12, 2025, at 3:00 PM in Parliament.

This will mark his inaugural budget statement since his appointment in late 2024, following a cabinet reshuffle.

This year’s budget is set at KSh 4.26 trillion, reflecting an increase from the KSh 3.98 trillion allocated in the 2024/25 financial year.

The increase comes amid rising national concerns over inflation, youth unemployment, and ballooning public debt.

Many observers see this as a litmus test for Mbadi’s leadership at the helm of the Treasury.

Revenue and Spending Plans

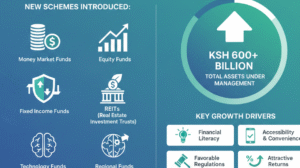

According to the recently published 2025/26 Budget Policy Statement, the government anticipates raising KSh 3.39 trillion in total revenue.

Of which KSh 2.84 trillion will be generated from ordinary revenue sources.

Indeed, this projection is driven by ongoing tax reforms and efforts to widen the tax base.

The proposed budget allocates:

KSh 3.1 trillion to recurrent expenditure

KSh 725.1 billion for development initiatives

KSh 436.7 billion as equitable share transfers to county governments

Despite the increased expenditure, the fiscal deficit is projected to reduce to KSh 831 billion, to be bridged through a combination of domestic and international borrowing.

The education sector will receive the largest allocation in the upcoming budget, with KSh 701 billion earmarked for various programs.

According to Treasury Principal Secretary Dr. Chris Kiptoo, this investment—though significant.

Still falls short of the actual financial requirements needed to meet growing demands in the sector.

Key allocations within the education budget include:

KSh 377 billion for salaries of Teachers Service Commission (TSC) staff

KSh 55 billion for free day secondary school capitation

KSh 41 billion for Higher Education Loans Board (HELB)

Additional funds will support university scholarships, primary and junior secondary school capitation, TVET institutions, intern teacher recruitment, and school feeding programs

Anticipated Reforms and Tax Proposals

As part of broader fiscal policy adjustments, the Finance Bill 2025 proposes several tax changes aimed at improving equity and boosting compliance.

These include:

Adjusting the cap on travel allowances

Modernizing pension-related tax clauses

Expanding taxation on digital income and services

These reforms are expected to support the government’s strategy for sustainable revenue growth while promoting fairness in the tax regime.

Political and Economic Significance

Mbadi’s budget presentation will be closely monitored by both domestic and international stakeholders, given its timing and economic implications.

The government faces increasing pressure to deliver tangible outcomes in job creation, inflation control, and debt management.

Having previously served as the Minority Leader in the National Assembly and as Chair of the Public Accounts Committee.

Also, Mbadi brings deep legislative and fiscal oversight experience to the role.

His debut at the budget podium symbolizes both political realignment and a critical moment in Kenya’s economic direction.

ALSO READ: CBC Out, CBE In! Inside Kenya’s Game-Changing Curriculum Overhaul