A Kenyan man is at the center of an international manhunt over allegations of stealing over $1.4 million in cryptocurrency during a high-stakes blockchain transaction gone awry.

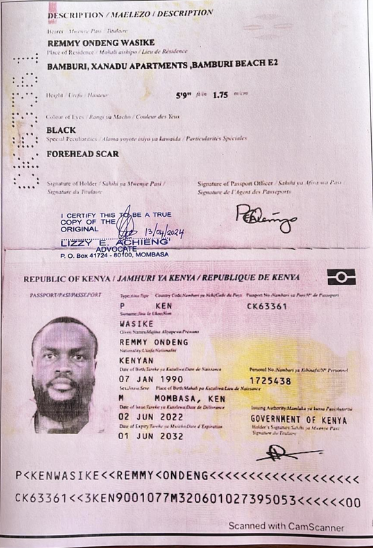

The suspect, identified as Remy Wasike through a copy of his passport, is believed to have misappropriated USDT 1,477,678 (over Ksh 190 million) meant for cross-chain processing, and is now being pursued by cybercrime units across multiple countries as well as international financial watchdogs.

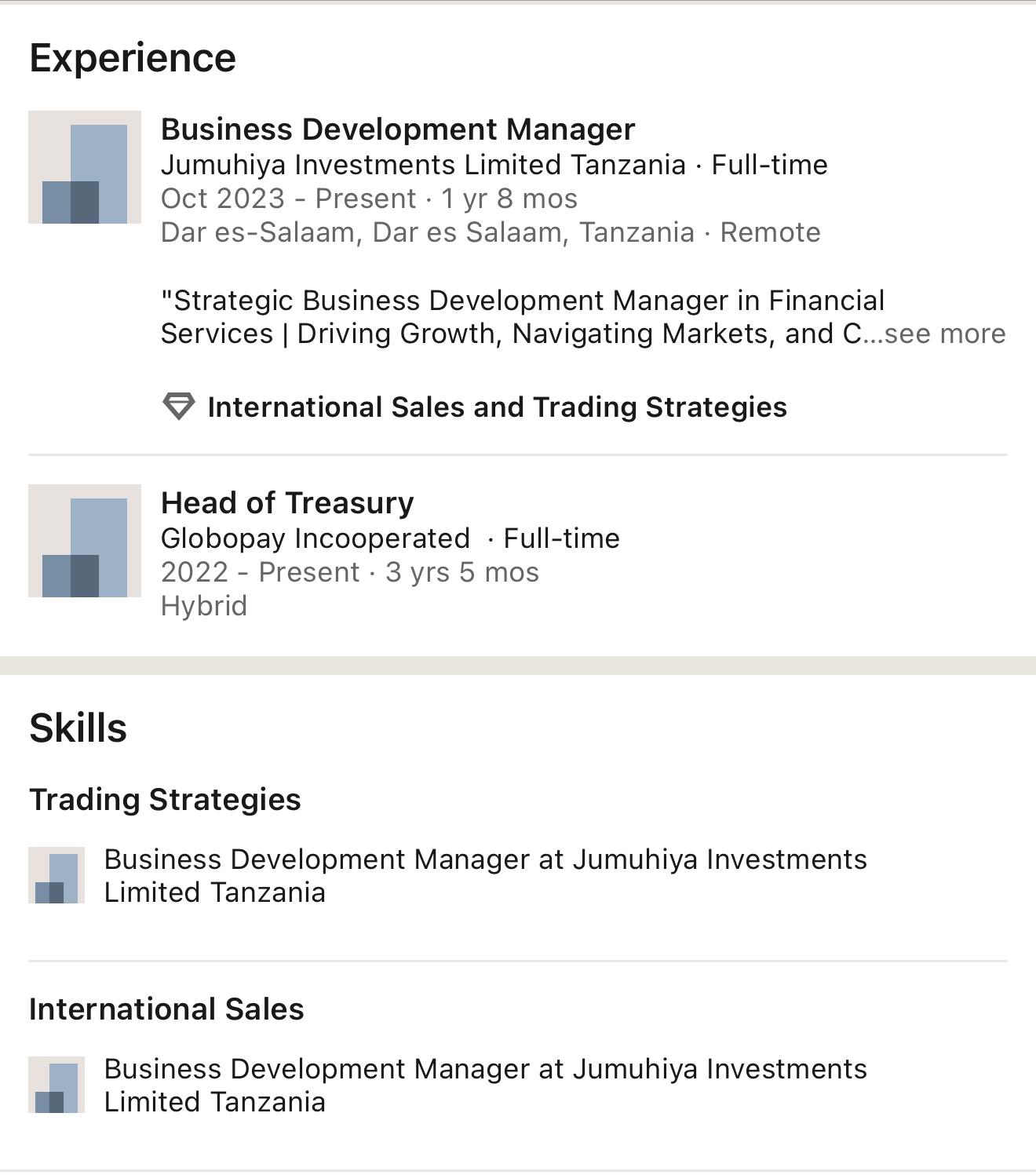

Wasike, a Kenyan national born on January 7, 1990, with a professional background in business development and treasury management in the financial services sector, currently holds managerial roles at Jumuhiya Investments Limited Tanzania and Globopay Incorporated.

He is easily identifiable by his 5’9″ height and a distinctive forehead scar.

A detailed statement circulated among digital asset stakeholders and law enforcement entities indicates that the disputed sum transferred on the TRC20 blockchain was not intended for Wasike’s personal use nor for the intermediary party (known as Bulent) but was reportedly meant to be processed and transmitted across chains on behalf of an undisclosed, well-resourced client whose identity remains confidential at this stage.

Sources close to the matter allege that despite the transaction being premised on mutual trust and operational clarity, the tokens in question were never transferred as agreed, prompting the client to initiate a multifaceted response involving international law enforcement and financial crime monitoring organizations.

It is understood that preliminary steps have already been taken, including the filing of complaints with cybercrime divisions in at least four jurisdictions, namely Turkey, the United Arab Emirates, Kenya, and Tanzania, while more escalation has been reportedly made to international oversight bodies, such as the Financial Action Task Force (FATF), under provisions related to cryptocurrency compliance and anti-money laundering enforcement.

The same communication claims that an initial forensic analysis of digital wallets allegedly linked to Wasike revealed potential associations with illicit online activities, including phishing and fraud-related incidents, and even referenced unverified connections to more serious categories such as financing of prohibited organizations, claims which carry severe legal implications across multiple jurisdictions.

The victim, however, appears to have adopted a tone that leaves the door open to resolution, stating that the matter could be settled amicably should the full amount be returned within a stipulated timeframe, specifically by Monday, May 26, 2025 after which they warn that the matter will proceed with full prosecutorial intent, asset recovery measures and likely international arrest warrants, should the repayment not be made in full.

As the situation continues to unfold, observers within both the digital finance space and broader law enforcement circles are closely monitoring how authorities across multiple jurisdictions respond to what is rapidly shaping up to be a landmark case in the evolving world of blockchain-related financial crime.

The victim, through their legal and investigative representatives, has encouraged any individuals, institutions, or entities who may possess information related to the whereabouts of the missing funds, the digital asset pathways involved, or the current location of the suspect, to come forward in strict confidence and share such details with the relevant authorities or investigative teams already seized of the matter.

This remains a developing story and we will continue to follow it closely as more information becomes available.

Below is the full communication from the victim’s representatives, outlining their stance on the matter.

“Hi Nyakundi. Remy Wasike appears to have misappropriated or stolen funds from a client of mine. The USDT TRC20 amounting to 1,477,678 does not belong to Bulent or to me. These tokens were entrusted to Wasike for cross-chain processing on behalf of a legitimate and well-resourced client. The TRC20 tokens sent to him are client funds originating from a demonstrably clean and legitimate source. The client has made it unequivocally clear that they will not accept this loss and will relentlessly pursue full and complete recovery. USDT 1,477,678 is a significant sum, and the client possesses substantial resources which they are prepared to expend in recovering the entire amount. Legal action has already been initiated against Wasike for recovery of the full USDT 1,477,678. The cybercrime divisions of Turkey, the United Arab Emirates, Kenya, and Tanzania have all received the case file. Additionally, the matter has been escalated to the Financial Action Task Force (FATF) due to recently updated cryptocurrency and stablecoin trading regulations, ensuring that this case will receive prioritized attention. Preliminary enhanced due diligence investigations have linked Wasike’s directly attributable wallets and accounts to phishing and scamming activities, as well as potential connections to terrorist financing—claims based on publicly available information which can be independently verified. Consequently, the client intends to pursue this matter fully with prosecutors, expecting full cooperation from authorities, and anticipates subsequent investigations, international arrest or apprehension warrants, and asset freeze orders. It is clear that the suspect is already feeling the effects of increased scrutiny from our collective network being made aware of these developments. However, it remains entirely within his power to prevent further escalation of this situation. We acknowledge that mistakes can happen, and as such, we offer the opportunity to return the full amount to the wallets listed below within 7 days. If the tokens—totaling USDT 1,477,678—are returned in full, we will sign a legal agreement waiving any further legal proceedings and consider the matter resolved. The deadline for full repayment is Monday, 26th May 2025, at 1200 hrs GST. I strongly urge Remy to return the funds. Pursuing recovery through legal channels is inevitable and will result in significant financial and criminal consequences at minimum.”