KEBS Imposes New Standards Levy on Kenyan Manufacturers

The Kenya Bureau of Standards (KEBS) has announced the implementation of a new Standards Levy on Kenyan manufacturers.

Therefore, signaling a major shift in how the government funds national quality and compliance initiatives.

The levy is set to reshape the cost structure for industries across the country and could have ripple effects on product prices and business competitiveness.

Background and Context

KEBS, established under the Standards Act (Cap 496), is mandated to set, promote, and enforce product and process standards in Kenya.

To sustain these operations, the agency has historically relied on a standards levy collected from manufacturers.

The original levy, introduced in 1990 through Legal Notice No. 267, has undergone minimal changes over the decades—until now.

The 2025 Standards (Standards Levy) Order introduces a more robust and structured collection system.

To all manufacturers, Please see attached the Standards Levy Order 2025, Public Notice for your information. ^GN pic.twitter.com/ECImTZf03V

— KEBS KENYA (@KEBS_ke) November 4, 2025

Therefore, ensuring KEBS has a steady revenue stream to maintain quality assurance, laboratory testing, metrology, and market surveillance functions.

The revision was also informed by growing demands for consumer protection and the need to keep pace with industrial growth and global competitiveness.

What’s New—The Revised Levy Order 2025

On 8 August 2025, a new Legal Notice, the Standards (Standards Levy) Order 2025 (Legal Notice No. 136), was gazetted to update and enforce the levy framework.

Key changes under the new order include:

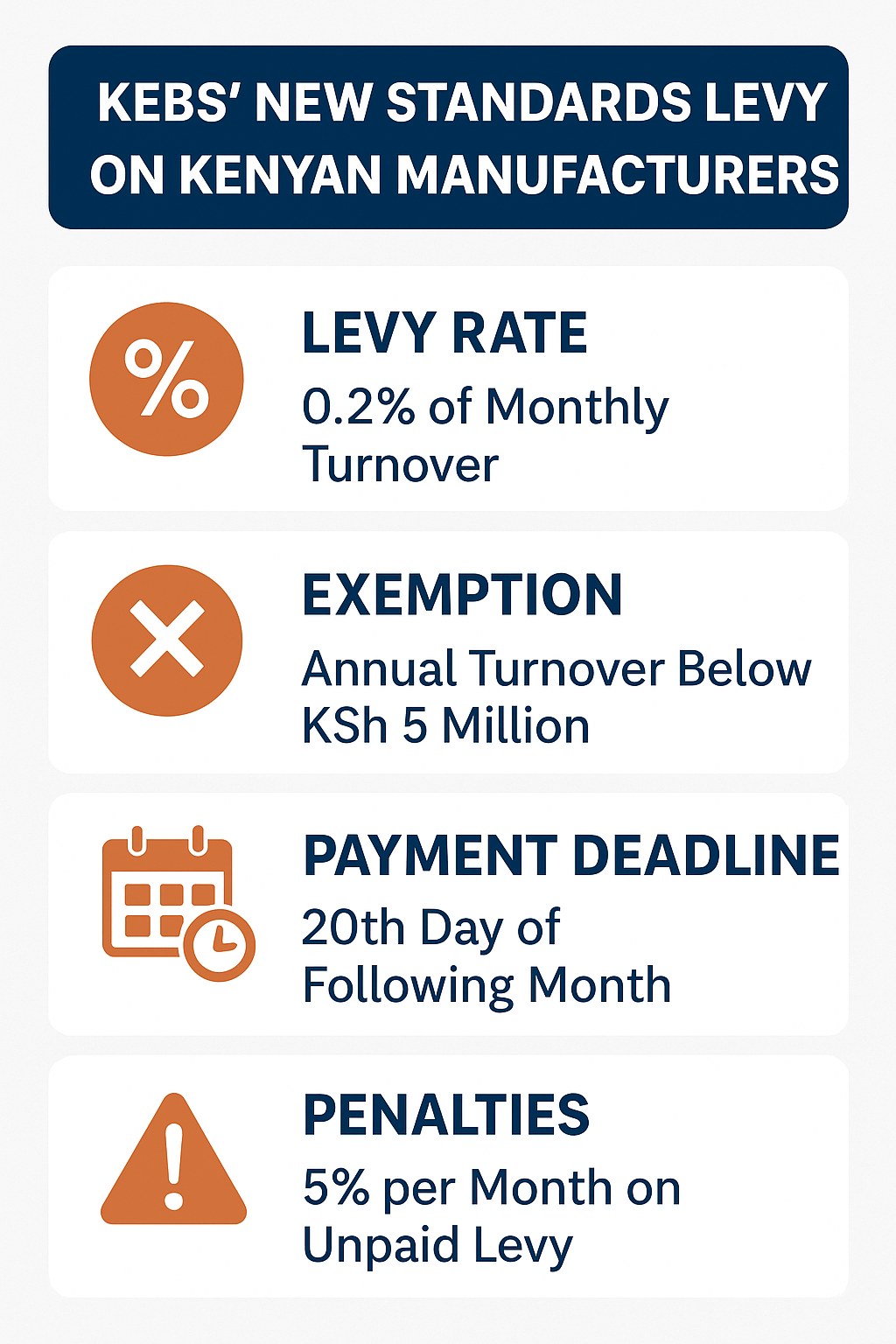

The levy rate is set at 0.2% (two-tenths of one percent) of the manufacturer’s monthly turnover (or value of goods manufactured) net of Value Added Tax (VAT), excise duty, and discounts.

A ceiling cap of KSh 4,000,000 annually (i.e., the maximum a manufacturer can pay in a year) is introduced for the first phase.

An exemption threshold: manufacturers whose annual turnover of goods manufactured (net of VAT, excise duty, and discounts) does not exceed KSh 5 million are exempt from paying the levy.

Payments are to be made through the Kenya Revenue Authority (KRA) iTax system by the 20th day of the month following the manufacturing month.

Failure to register as a manufacturer with KEBS (via Form SL/1) or to pay the levy triggers penalties: 5% per month of the amount unpaid.

The definition of “manufacturer” is broad and covers producing, processing, treating, installing, testing, operating, or using goods/processes. The scope spans many sectors such as textiles, food processing, engineering, electrical, chemical, and construction.

Rationale Behind the Levy

KEBS maintains that the levy is essential to reduce dependence on exchequer funding and to ensure sustainable financing for its regulatory operations.

The agency argues that the funds will enhance its ability to enforce standards, improve product quality, strengthen consumer protection.

In addition to promoting fair competition in domestic and export markets.

Officials have emphasized that the measure is also about equity and accountability.

Thus, ensuring that all players benefiting from the standards infrastructure contribute proportionally to its maintenance and improvement.

Impact on Manufacturers and Consumers

While KEBS insists the levy will support a stronger quality regime, the manufacturing sector has expressed mixed reactions.

For many medium and large manufacturers, the levy adds to existing compliance costs in an already high-cost business environment.

Industry stakeholders warn that the additional expenses could be passed down to consumers.

Therefore potentially leading to an increase in the prices of locally manufactured goods.

Smaller manufacturers, though exempt, fear the turnover threshold could pressure them to remain below growth targets to avoid crossing into the taxable bracket.

Others argue that the government should have staggered implementation to allow the sector to adjust.

Nonetheless, some experts believe that over time, better quality assurance and reduced counterfeit goods could offset the initial cost burden.

Improved standards could also strengthen Kenyan products’ competitiveness in regional and international markets, driving long-term gains for compliant businesses.

Compliance and Enforcement

To comply with the new rules, all manufacturers must register with KEBS through Form SL/1 and maintain accurate records of monthly turnover.

Payments must be made promptly through the KRA iTax platform, and firms are encouraged to integrate the levy into their monthly cost planning.

Non-compliance is a criminal offense under the Standards Act.

KEBS has already begun outreach campaigns and digital registration drives to ensure a smooth transition.

Broader Economic Implications

The introduction of the Standards Levy comes at a delicate time when Kenya is pushing for industrial expansion under the Bottom-Up Economic Transformation Agenda (BETA).

The levy aims to boost institutional capacity without straining government resources, but it must be carefully managed to avoid discouraging manufacturing investment.

Transparency will be crucial. Manufacturers have called on KEBS to clearly demonstrate how the levy proceeds are used.

Whether in upgrading laboratories, hiring inspectors, or supporting local testing facilities.

Without visible results, the levy risks being perceived as another tax burden rather than a development tool.

Conclusion

The KEBS Standards Levy represents a decisive step toward sustainable funding for Kenya’s quality infrastructure.

While its 0.2% rate may appear modest, its implications for manufacturing costs, consumer prices, and investment sentiment are substantial.

For now, manufacturers must adapt, comply, and prepare for a more regulated and accountable industrial environment.

In the long term, if well-managed, the levy could strengthen Kenya’s manufacturing ecosystem.

But if poorly implemented, it risks becoming yet another weight on an already burdened sector.

ALSO READ: Youngest Self-Made Billionaires: How 3 Friends Built a $10B AI Empire