The Kenyan government has opened a historic opportunity for both local and international investors to own a piece of one of the country’s most strategic energy firms. The Kenya Pipeline Company Limited (KPC) has officially launched its Initial Public Offering (IPO) at the Nairobi Securities Exchange (NSE), offering shares at Ksh9 each.

The IPO is set to run from January 19 to February 19, 2026, with the government selling 65% of KPC’s issued ordinary shares. Experts project the sale could raise up to Ksh106 billion, marking it as the largest IPO in Kenya’s history.

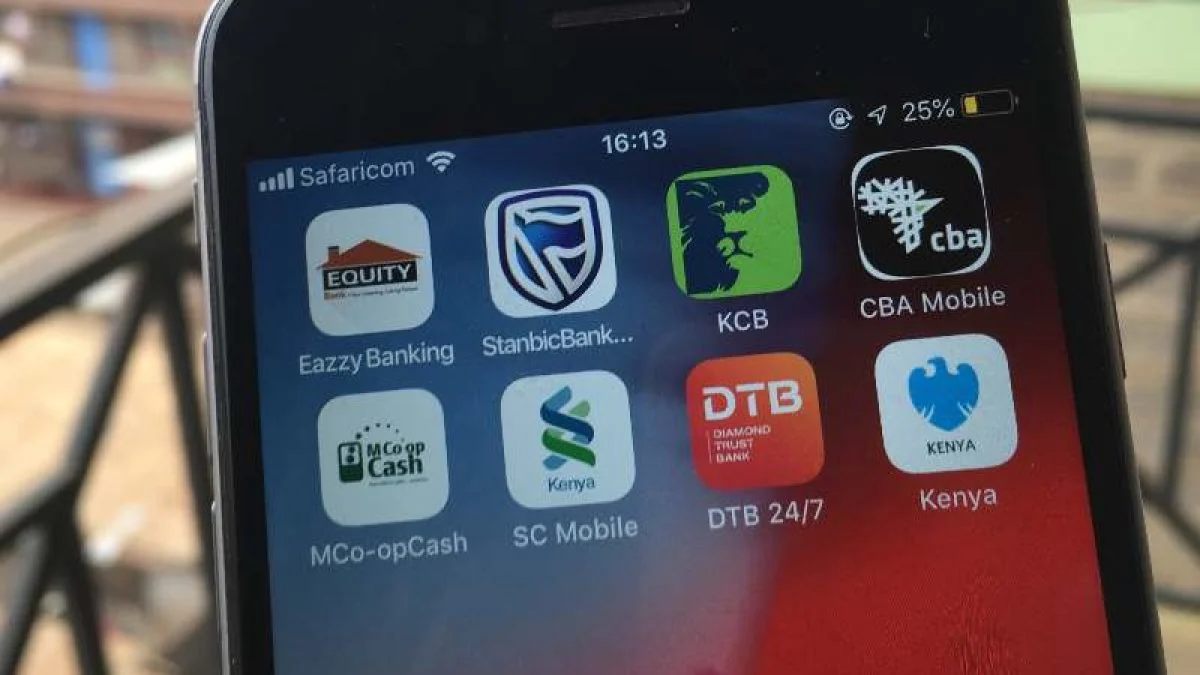

This digital-first IPO is designed for maximum transparency and accessibility, allowing investors to participate using USSD codes or an online portal. Whether you are a seasoned stock trader or a first-time investor, the process has been simplified to ensure everyone has a fair chance to acquire shares in this strategic national asset.

Investing in KPC shares is straightforward if you follow the steps outlined by the government and the Privatisation Authority. The IPO has been structured to accommodate various investor categories, providing multiple platforms for application. Below is a breakdown of the process:

Step 1: Prepare Your Central Depository System Account

To apply, you must have a valid Central Depository System (CDS) account. If you don’t have one, visit a licensed stockbroker or investment bank to open an account before applying. Your CDS account is essential because:

- It records your share ownership electronically.

- It allows for smooth allocation and transfer of shares.

- It ensures secure receipt of dividends once KPC starts paying.

Step 2: Choose Your Application Method

KPC’s IPO allows investors to apply using two main channels, depending on access to technology:

| Application Method | How to Apply | Notes |

|---|---|---|

| USSD (Mobile) | Dial 483816# from a registered Kenyan mobile number | Available only for individual investors |

| Online Portal | Access via internet-enabled device | Open to all investor categories |

Once you select your method, you will need to read and accept the IPO’s terms and conditions before proceeding.

Step 3: Complete Your Application

When applying, investors must provide:

- Their CDS account number.

- Investor category (individual, institutional, etc.).

- The number of shares desired (minimum 100 shares at Ksh900).

Payments are integrated into the application process, which can be made through:

- Mobile money platforms (e.g., M-Pesa).

- Bank transfers or electronic funds transfers.

- Brokerage account balances, if applicable.

After submission, all applications are reviewed. In cases of oversubscription, applicants may receive fewer shares than requested. Excess funds will be refunded automatically.

Step 4: Allocation and Trading

Share allocation will occur after the IPO closes on February 19, 2026. Successful applicants will receive their shares directly into their CDS accounts ahead of KPC’s official listing at the NSE. Trading is set to commence on March 9, 2026, allowing investors to buy and sell shares on the open market.

Investing in Kenya Pipeline Company shares is not just about potential financial returns—it’s also a way to support strategic national infrastructure.

The Treasury has confirmed that proceeds from the IPO will be used within the national budget framework, specifically as seed capital for the National Infrastructure Fund. This fund will finance key projects in:

- Energy

- Roads

- Airports

- Water and sanitation

- Other strategic public sector projects

Owning KPC shares gives investors a stake in a company central to Kenya’s energy distribution network while contributing to national development projects.

Tips for First-Time Investors

- Start with the minimum 100 shares to familiarize yourself with the stock market.

- Ensure your mobile and internet details are updated to avoid application errors.

- Keep track of the IPO timeline to ensure your application is submitted before February 19, 2026.

- Consider diversifying your investment portfolio instead of putting all funds into one IPO.

The KPC IPO is more than a stock sale—it is a historic moment for Kenya’s financial and energy sectors. By following the outlined steps, investors can confidently participate in this fully digital offering and secure ownership in one of the country’s most critical companies.