Absa Bank Kenya is facing a storm of scrutiny following the client mismanagement crisis at Absa Bank, triggered by the unfolding New Mega Africa Ltd matter. Serious gaps in internal controls, client handling, and staff accountability have emerged, exposing the bank to potential litigation, regulatory scrutiny, and reputational damage.

In response, Group Managing Director Kenny Fihla has demanded immediate action, instructing that all staff implicated in mismanagement, procedural failures, or unethical conduct be addressed decisively. The bank’s operations, staff morale, and client trust now hang in the balance.

How the Absa Bank Client Mismanagement Crisis Unfolded and Shook Corporate Banking

The client mismanagement crisis at Absa bank has triggered a wave of internal personnel changes as the bank attempts to stem operational weaknesses and rebuild client confidence. Key exits and disciplinary actions illustrate the extent of the crisis.

Sophie Omondi Resigns Under Pressure

Sophie Omondi, formerly a relationship manager in Mombasa, resigned, citing intense internal pressure. She claims she was coerced to provide false affidavits, despite never handling the New Mega Africa account. Her departure has raised serious questions about internal pressure, staff morale, and how reliant the bank is on employees under duress for sensitive legal matters.

Adding to the turmoil, Sophie alleges that Absa Bank has given negative references to prospective employers, tying her name to mismanagement claims in another high-profile case involving Shakab Tea Exporters, a Mombasa-based company.

The Shakab case highlights severe missteps: the bank allegedly canceled facilities arbitrarily, discussed sensitive business information with competitors, and demanded kickbacks to access banking facilities. These actions led Shakab to lose a major export client and incur heavy penalties from the East Africa Tea Traders Association (EATTA).

Documents indicate that Shakab was forced to pay USD 1,655,483.59 twice for pre-shipment stock already in its warehouses. Post-shipment receivables totaling USD 2,295,390.18 were also mishandled under an overdraft arrangement of USD 1,500,000, rather than being properly credited. Sophie Omondi’s exit symbolizes broader operational and ethical lapses in staff management.

Executive-Level Changes

Elizabeth Wasunna, the former business banking director, was asked to step down by the board following alleged mismanagement, client dissatisfaction, financial losses, and litigation exposure. Wasunna claims she became a scapegoat for systemic leadership failures within the Executive Committee. During CEO Abdi Mohamed’s tenure, Credit and Finance teams reportedly operated independently, circumventing senior oversight.

Renato D’Souza, recruited from Stanbic Bank by Group MD Kenny Fihla, has been tasked with addressing legacy client disputes, closing operational gaps, and restoring confidence in the bank’s business banking operations. His role will be central to stabilizing the troubled client accounts and preventing further litigation.

Meanwhile, Serah Muthui, a controversial staff member, is facing serious allegations ranging from intimidation and leaks of client data to links with criminal activity. Her name has surfaced in multiple cases, including Mwangi Macharia vs Absa Bank (Cause E065 of 2023). Reports claim she was involved in incidents where bank clients were followed after withdrawals, raising questions about internal controls and staff vetting.

Wycliffe Makori, considered a key witness in the New Mega Africa case, is accused of using his access to internal accounts to sell client information to competitors. Despite allegations, the bank appears intent on retaining him due to the critical nature of his testimony. This situation underscores operational risks arising from reliance on conflicted staff members in high-profile cases.

Client Relations Under Fire

The issue of the client mismanagement crisis at Absa Bank has had serious repercussions for the bank’s corporate clients, with two cases, in particular, highlighting systemic failures.

New Mega Africa Matter

The New Mega Africa case involves allegations of unauthorized sharing of confidential client information, blackmail, solicitation of funds, and delays in credit facility restructuring following the post-COVID economic downturn. The matter has drawn regulatory attention, exposing weaknesses in client management, documentation, and staff oversight. Internal reviews are ongoing, aiming to identify personnel lapses and prevent recurrence.

Shakab Tea Exporters Litigation

Shakab Tea Exporters’ legal battle against Absa Bank exposed operational mismanagement and unethical conduct. The court ruled in favor of Shakab, ordering Absa not to interfere with the company’s business operations.

This decision highlights the reputational risks that the bank faces due to poor handling of corporate client relationships. The ruling also reinforces the consequences of overreach and procedural failure, underscoring the need for stringent compliance measures.

Board Action and Regulatory Oversight

Group MD Kenny Fihla has made clear that accountability, transparency, and operational integrity are non-negotiable. Immediate measures include:

- Investigating personnel implicated in the New Mega Africa and related matters.

- Strengthening internal controls over sensitive client data.

- Reviewing employee conduct, incentives, and compliance training programs.

- Enhancing monitoring of senior relationship managers and corporate credit staff.

The Board has explicitly linked personnel changes to the bank’s broader operational and reputational recovery.

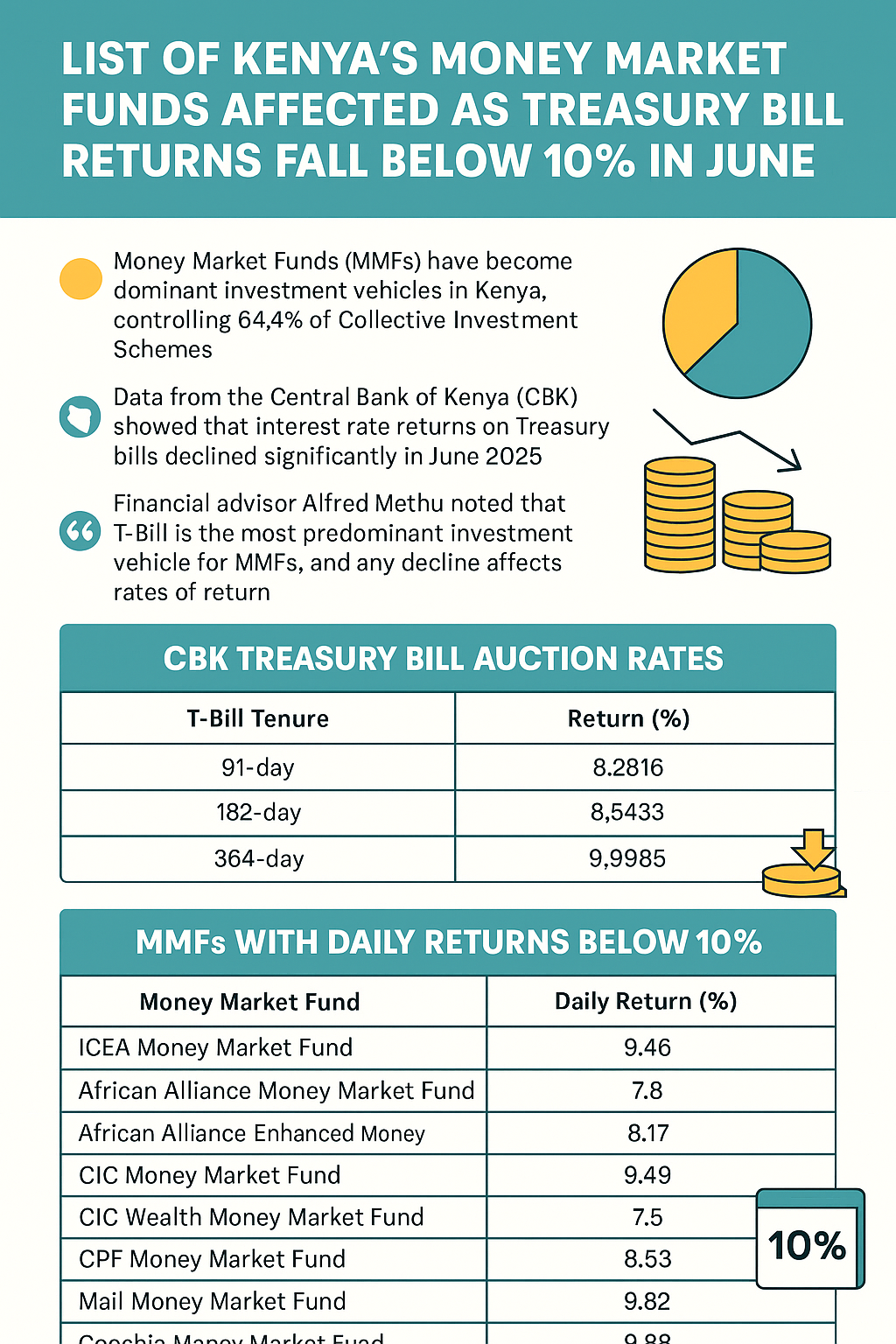

Regulatory bodies, including the Central Bank of Kenya (CBK), have issued letters prompting the bank to address systemic failures. Compliance issues such as mishandling confidential client information, staff accountability in high-risk accounts, and adherence to corporate governance standards are now under scrutiny.

Operational Risks and Future Outlook

The mismanagement crisis underscores deep-rooted challenges in staff oversight, client management, and executive accountability. The departures of key personnel, coupled with ongoing litigation and regulatory probes, signal a bank under immense pressure to restore credibility.

Absa Bank’s leadership recalibration, including the recruitment of experienced executives like Renato D’Souza and strict directives from Kenny Fihla, indicates a proactive approach. Yet, the effectiveness of these measures will depend on consistent enforcement of internal controls, rigorous oversight of high-risk client accounts, and rebuilding trust with corporate clients.

If the bank succeeds in stabilizing operations and addressing the gaps revealed by the New Mega Africa and Shakab Tea Exporters cases, it may regain confidence among clients, regulators, and stakeholders. Failure, however, could deepen reputational damage and invite further scrutiny, making transparency and accountability the cornerstones of Absa’s recovery strategy.

Shakab Imports Exports Company Limited v Absa Bank Kenya Plc another (Commercial Suit E068of2024) 2025KEHC12104(KLR) (30June2025) (Ruling) (1)