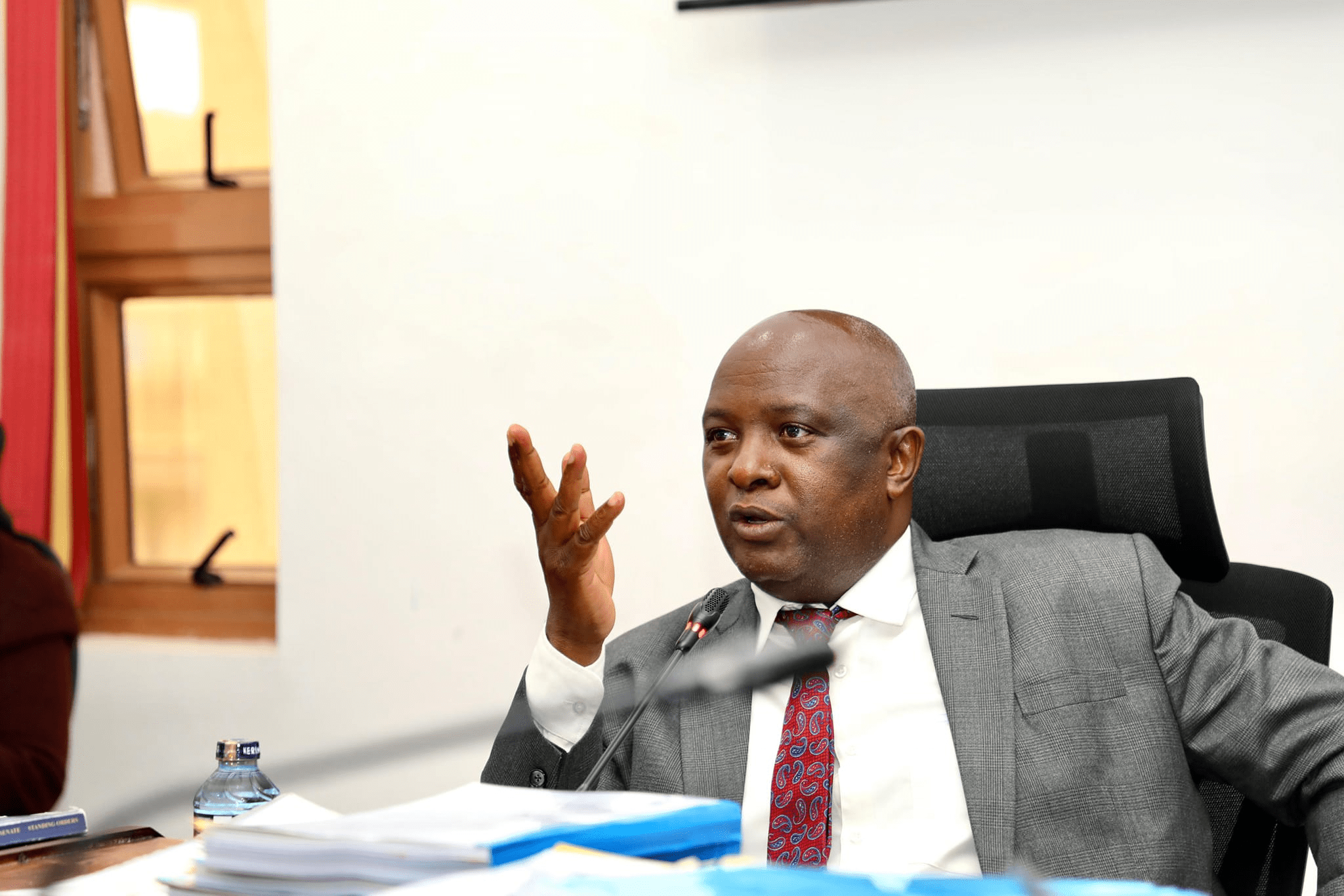

Kenya is facing a serious financial crisis after a new public audit revealed that KSh 300 billion raised through government bonds between 2017 and 2023 is untraceable. Busia Senator Okiya Omtatah has demanded urgent answers from the Auditor General following the shocking revelation.

The audit highlights a significant accountability gap in the management of public funds, raising concerns about transparency within the National Treasury and the Central Bank of Kenya. Citizens are left asking how billions meant for development projects simply disappeared.

Auditor General Fails to Trace KSh 300 Billion Bond Proceeds Exposing a National Accountability Crisis

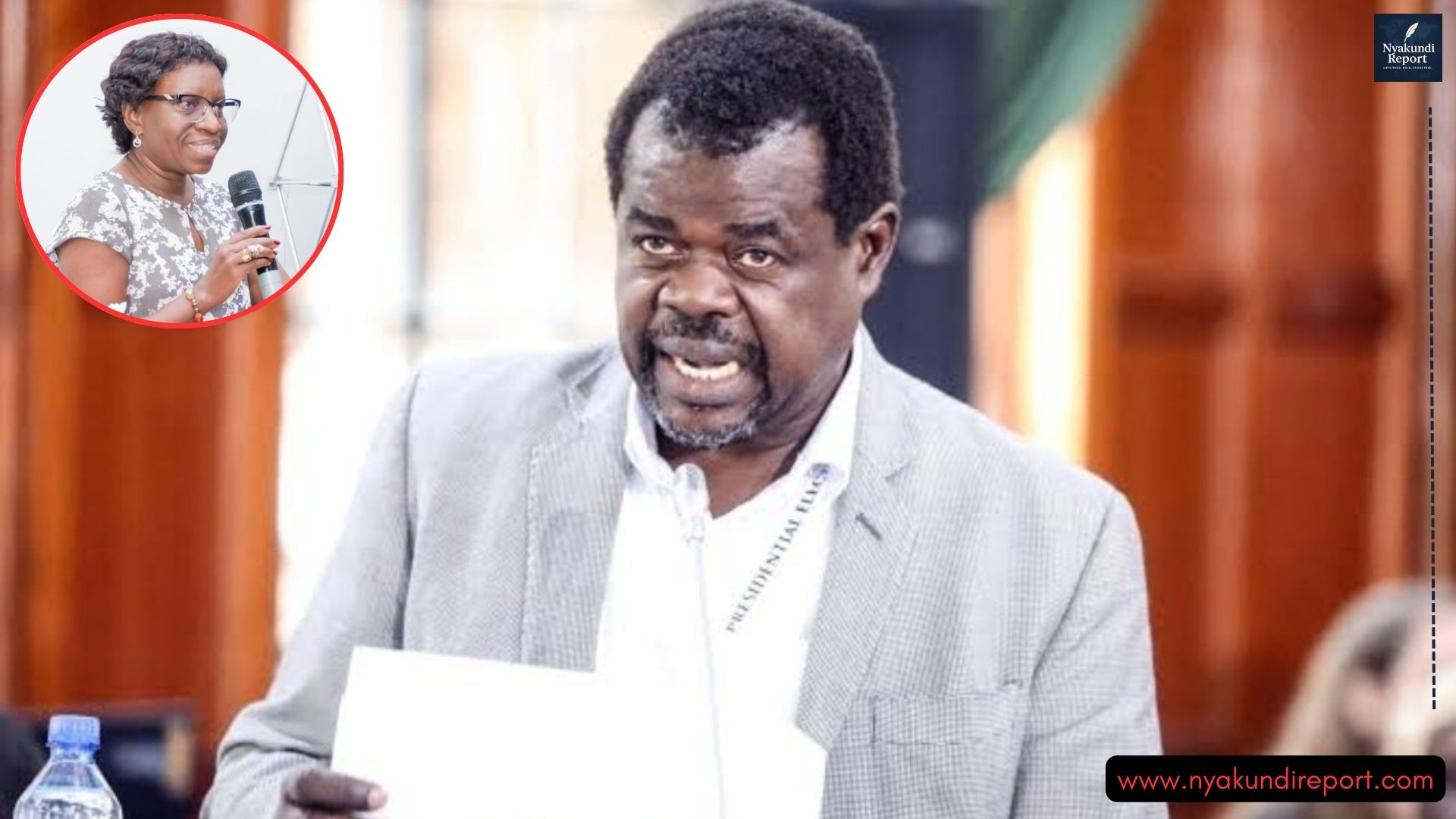

The audit, presented by Auditor General Nancy Gathungu, shows that the National Treasury collected KSh 2.97 trillion from domestic borrowing over six years. Yet only KSh 2.67 trillion was deposited into the Consolidated Fund. This leaves a staggering KSh 300 billion gap that remains unexplained.

Senator Omtatah warned that the figures point to a full-blown accountability crisis. “Money does not vanish, it is made to vanish. Those responsible must be held personally liable,” he said. The missing funds represent more than just numbers—they threaten the very trust Kenyans have in their public institutions.

KSh 300 Billion Missing from Consolidated Fund Raises Questions

The discrepancy raises urgent questions about how bond proceeds, borrowed on behalf of Kenyans, were managed. Part of the traced KSh 2.67 trillion was used to service domestic debt rather than support critical development projects.

Omtatah emphasized that public finance laws demand transparency and accountability. He pointed out that Article 201 and 206 of the Constitution obligate the government to disclose all financial activities. The unaccounted KSh 300 billion could indicate systemic mismanagement within the Treasury and Central Bank, he said.

Auditor General Fails to Trace KSh 300 Billion Bond Proceeds Showing Weak Oversight

The Auditor General’s report highlights gaps in financial tracking and oversight. Despite her efforts, she could not reconcile the full amount of bond proceeds. This failure raises concerns over whether proper auditing mechanisms are in place to monitor billions of shillings borrowed from the public.

Omtatah warned that the inability to trace such a large sum of money could have catastrophic implications for public trust. “If the Auditor General cannot trace funds raised through government bonds, then we are staring at a full-blown crisis of accountability,” he said.

Senator Vows to Pursue Answers in Parliament and Courts

Senator Omtatah promised to escalate the matter across multiple fronts—Parliament, the courts, and the public domain. He insisted that Kenya is not a private enterprise and that the Constitution must guide all public finance decisions.

He called for personal accountability for anyone found responsible for mismanaging public funds. The Senator’s resolve indicates that pressure on the National Treasury and Central Bank will intensify until clarity is provided on the missing KSh 300 billion.

The audit report and Omtatah’s warnings signal a watershed moment for Kenya’s financial governance. With public debt continuing to strain households, the demand for transparency and accountability has never been more urgent. Citizens and lawmakers alike are watching closely to see if the institutions in charge will respond or continue to let billions of shillings slip through their fingers.