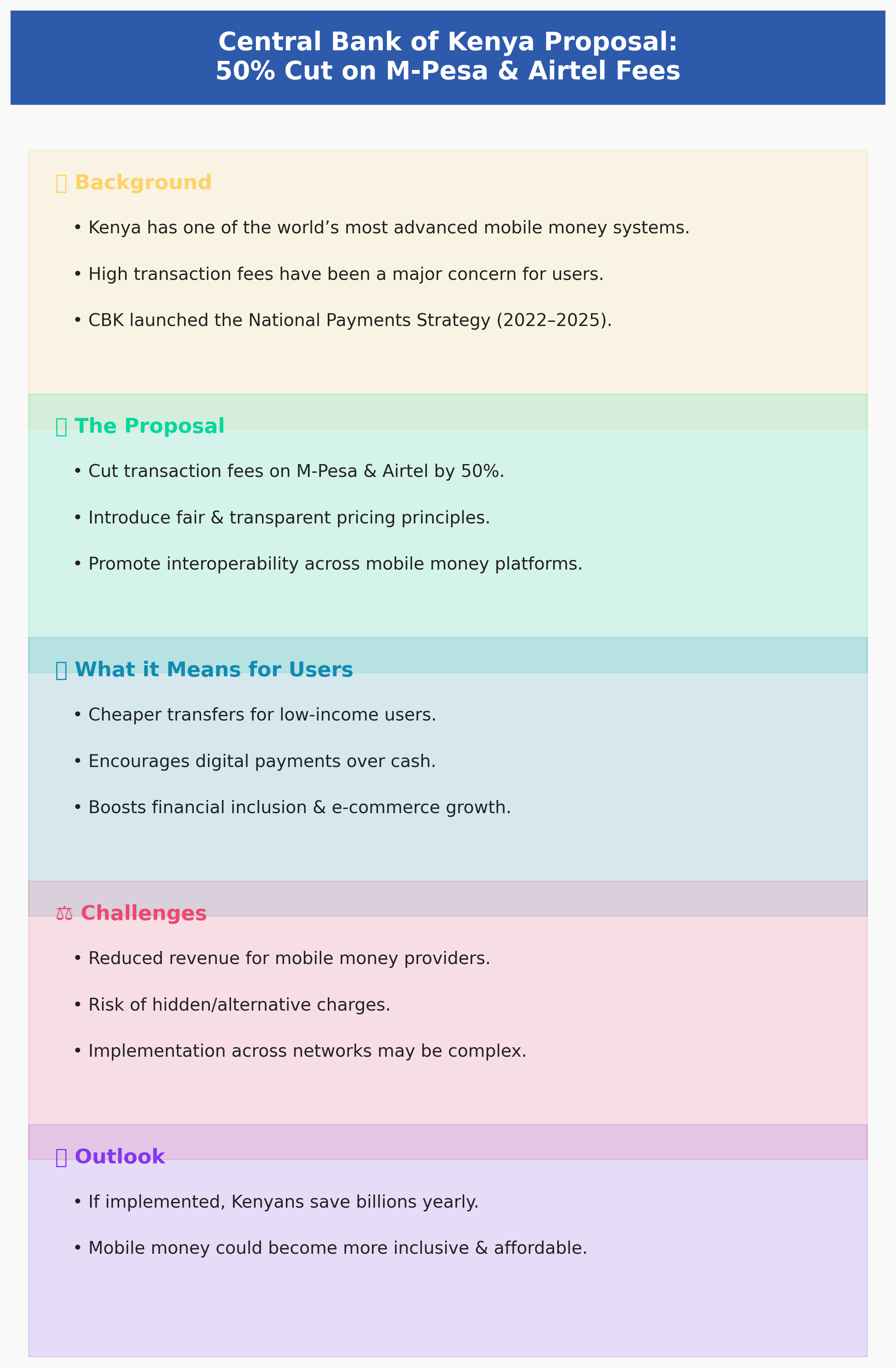

Therefore, effectively proposing and then enforcing a significant reduction.

And in some cases, by nearly half or more on fees charged by mobile money platforms.

Including the dominant M-Pesa and its main competitor, Airtel Money.

This move is part of a broader regulatory mandate to foster financial inclusion and encourage a cashless economy.

And ensure the affordability of Kenya’s globally renowned mobile money ecosystem.

The Rationale: Affordability and Financial Inclusion

The CBK’s action is anchored in its National Payments Strategy 2022-2025.

This is driven by a commitment to lower the cost of accessing and using financial services for the average Kenyan.

While Kenya boasts over 91% mobile money penetration, frequent complaints about high transaction costs, especially for low-value and cross-network transfers, have long persisted.

The policy was most prominently applied following the expiry of the emergency COVID-19 measures.

Which had temporarily waived fees for certain transactions.

When the CBK announced the reintroduction of charges, it came with a crucial caveat.

In addition, the new tariffs would be significantly lower than pre-pandemic rates.

Thus, ensuring that the convenience of digital payments remained accessible and affordable for both individuals and small businesses.

Specifics of the Drastic Price Cuts

The actual reduction implemented by the CBK for various transaction categories aligned with the policy objective of cutting costs by almost half:

Impact on Consumers and the Economy

The primary beneficiary of the CBK’s regulatory push is the consumer.

Lower fees are expected to:

- Boost Small-Value Transactions: Encouraging Kenyans to use mobile money for everyday, small-value payments instead of reverting to cash.

- Deepen Financial Inclusion: Making digital financial services more appealing and accessible to the millions of Kenyans who still operate largely in the informal sector.

- Enhance Competition: By regulating maximum fees, the CBK ensures that even dominant players like Safaricom’s M-Pesa are compelled to offer competitive rates, creating a more level playing field for Airtel Money and other emerging Payment Service Providers (PSPs).

The policy is seen as a strategic lever to consolidate the gains made during the pandemic.

Therefore, ensuring that the country’s progress toward a ‘cash-lite’ economy is not reversed by punitive pricing.

The Challenge for Telcos

While the move is celebrated by consumers and financial inclusion advocates.

It presents a significant financial challenge to the mobile network operators (MNOs).

Particularly, Safaricom, which derives a substantial portion of its revenue from M-Pesa transaction fees.

For Safaricom and Airtel, the reduction means a direct hit to the profitability of their mobile money segments.

Operators must now pivot their business models to compensate for the lower transaction margins.

This is likely to spur greater innovation in non-core mobile money services such as savings, credit (like Fuliza), insurance, and investment products, where margins may be higher.

In response to the CBK’s directive, the telcos were required to introduce new, revised pricing structures.

Safaricom, acknowledging the regulatory guidance and the economic circumstances, announced its revised tariffs.

Thus, confirming the cuts for the lower value transaction bands and the continuation of zero-rated transfers below a certain threshold.

The Central Bank of Kenya’s action is a clear statement that the benefits of digital innovation must be shared with the consumer.

By drastically slashing transaction costs, the CBK reinforces Kenya’s global standing as a leader in mobile money.

Also, demonstrating that innovation and affordability can, and must, go hand in hand.

ALSO READ: Booed on Debut? How Alejandro Garnacho Handled His First Chelsea Start Under Pressure