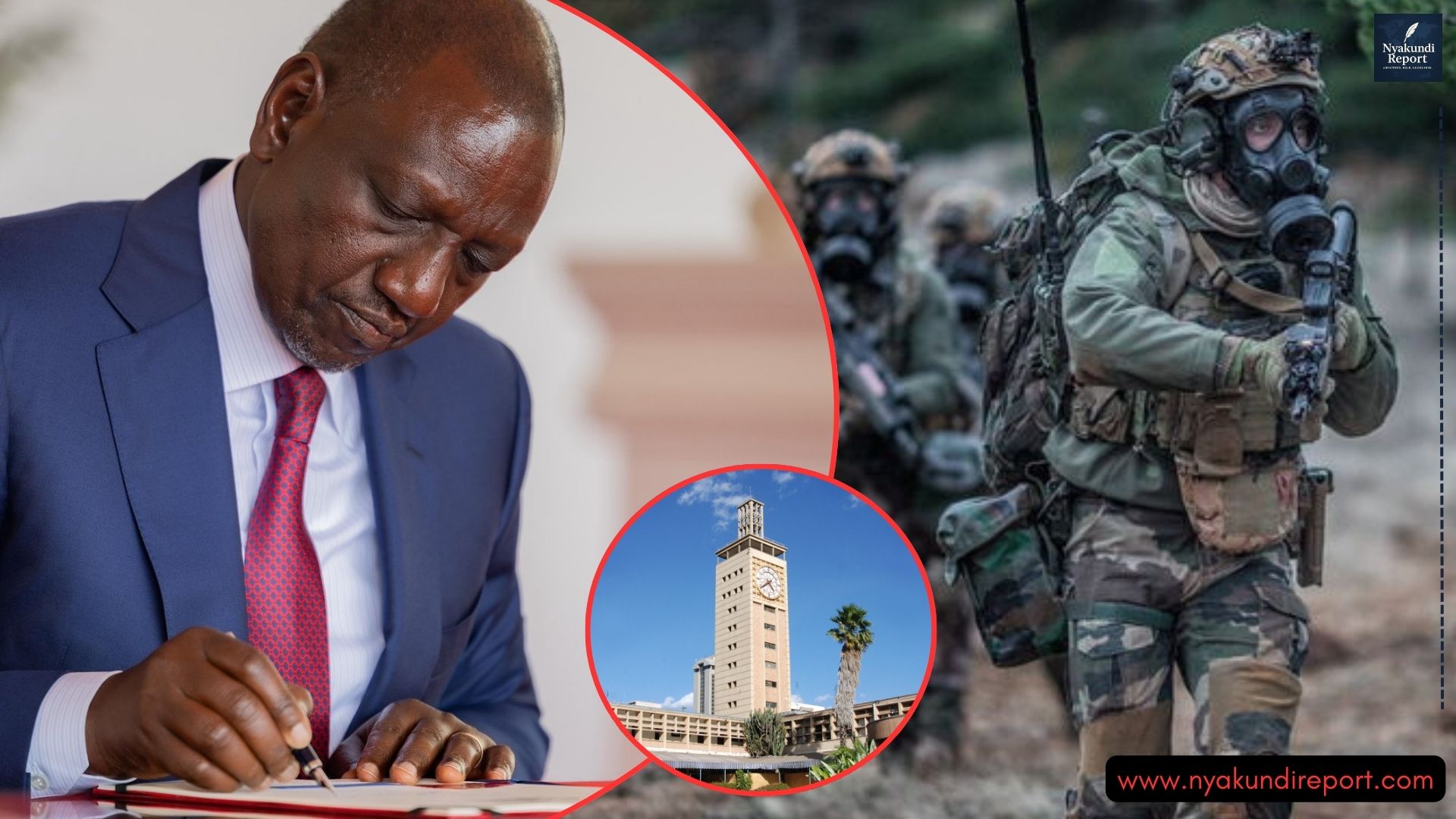

Just weeks after violent nationwide protests shook investor confidence in Kenya, the government has responded with a bold financial move aimed at stabilizing its investment climate.

In a high-level agreement signed during the Africa Debate Forum in London, Kenya secured a landmark deal that could unlock over Ksh260 billion ($2 billion) in foreign investments by protecting global capital from political, regulatory, and economic risks.

The deal comes at a critical time as the country fights to maintain credibility in the eyes of wary international investors.

Inside Kenya’s Deal to Protect Foreign Investments from Protests

The agreement was signed between the Nairobi International Financial Centre Authority (NIFCA) and Africa Specialty Risks (ASR), a global insurance and reinsurance powerhouse. It was sealed in the presence of Treasury Cabinet Secretary John Mbadi and Industry CS Lee Kinyanjui, signaling a full-throated endorsement from Kenya’s top leadership.

ASR, which has access to AA-rated global reinsurance markets, will now provide de-risking support for projects worth up to Ksh260 billion across Kenya. This includes infrastructure, logistics, energy, trade, and healthcare sectors—all of which have historically attracted interest but been plagued by uncertainty and red tape.

By absorbing some of the financial risks that come with investing in Kenya, ASR will reduce the cost of capital and make the country a more competitive destination. The arrangement is expected to fast-track stalled deals and bring in major funding from institutional investors, sovereign wealth funds, and private equity players who had pulled back following weeks of civil unrest.

“This agreement sends a clear message: Kenya is open for business, and we’re ready to protect those who invest here,” said NIFCA CEO Daniel Mainda during the signing ceremony.

For years, concerns about legal instability, abrupt policy changes, and corruption have haunted foreign investors. The recent anti-government protests only worsened those fears. Now, this de-risking framework offers a strong buffer against volatility, positioning Kenya as a secure hub for long-term investment.

Boost for Reinsurance and Kenya’s Financial Hub Ambitions

Kenya’s move is not just about foreign money—it’s also about building local capacity. The ASR deal is expected to trigger massive growth in the country’s struggling reinsurance and specialty insurance markets. By partnering with a global player, Kenya could start developing its own expertise in managing high-risk investment environments.

“Together, these agreements represent a new chapter for Kenya’s financial services sector,” said a statement from the National Treasury. “NIFCA is leading the charge to attract premier global institutions into the Nairobi International Financial Centre—driving innovation, resilience, and long-term economic transformation.”

This strategy aligns with Kenya’s vision of turning Nairobi into the financial nerve center of East and Central Africa. With other African cities like Kigali and Lagos also vying for the same position, Kenya is making a calculated play to stay ahead in the race for capital.

The use of de-risking at this scale is rare in Africa. If successfully implemented, Kenya could become a model for how to use insurance to attract global capital even in politically unstable environments.

Kenya Secures Multiple Deals in London to Protect Foreign Investments from Political Unrest

In addition to the ASR agreement, Kenya also signed a second deal with the Bupa Group—a global leader in health insurance and medical services. This deal aims to catalyze private sector investment in healthcare and expand access to high-quality medical services in the country.

The Treasury believes this will pave the way for more sustainable financing models and position Kenya as a hub for healthcare innovation in the region.

Also signed in London was a partnership agreement with the Africa Finance Corporation (AFC). This agreement is expected to boost investment in infrastructure and green finance, aligning with Kenya’s long-term development agenda and its commitment to sustainability.

By securing these deals, the Kenyan government is trying to restore international trust following the political upheaval that disrupted lives, businesses, and institutions. The hope is that with risk-sharing mechanisms and guaranteed investor protections, Kenya can lure back the capital it desperately needs for job creation, infrastructure, and innovation.

But critics are warning that deals alone are not enough. Unless the government addresses the root causes of unrest—corruption, inequality, and runaway public spending—the investment climate will remain fragile, no matter how many signatures are penned in London.

For now, however, the government is betting that a well-insured investor is a confident one. And with over Ksh260 billion in potential capital now under protection, the stakes have never been higher.