A recent drop in Treasury bill (T-bill) returns has sent ripples through Kenya’s financial markets.

Especially among Money Market Funds (MMFs), which are heavily invested in these government securities.

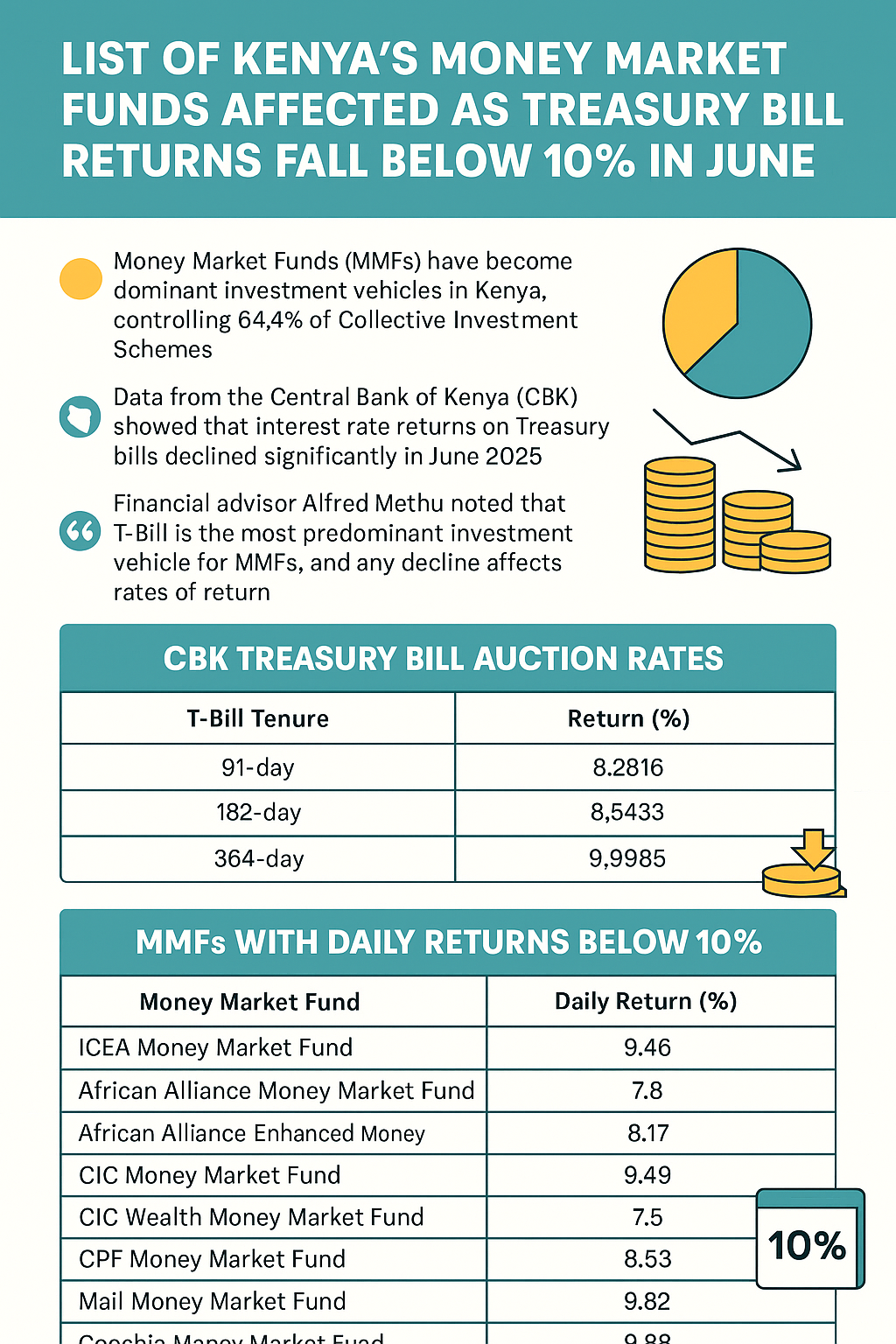

Data from the Central Bank of Kenya (CBK) shows that for the first time in months, all three T-bill tenures posted returns below 10% in June.

Therefore, signaling a shift in short-term interest rates and affecting investor earnings.

Money Market Funds: Kenya’s Preferred Investment Option

Money Market Funds have steadily gained popularity in Kenya, commanding over 64.4% of all collective investment schemes.

Their appeal lies in the promise of low-risk, stable returns, often tied to government debt instruments such as T-bills.

Unit Trust managers allocate a large portion of these pooled funds to short-term securities in pursuit of consistent yields.

According to the Capital Markets Authority (CMA), these funds manage assets worth over KSh 319.7 billion.

Also, reflecting strong public confidence and a growing appetite for secure, short-term investments.

Treasury Bill Auction Results: June 6, 2025

CBK’s T-bill auction held on June 6, 2025, saw a total of KSh 57.4 billion raised—well above the targeted KSh 24 billion.

However, despite the oversubscription, the yields offered fell below the symbolic 10% threshold across all maturities:

| T-Bill Tenure | Return (%) |

|---|---|

| 91-day | 8.2816% |

| 182-day | 8.5433% |

| 364-day | 9.9985% |

This marked a drop from previous rates of 8.2927%, 8.5642%, and 10%, respectively, recorded in the last auction cycle.

Expert Insight: What It Means for MMFs

Financial advisor Alfred Methu highlighted that MMFs are directly affected by movements in T-bill yields due to their investment structure.

“The bulk of MMF portfolios consist of T-bills. So when rates fall, the earnings distributed to MMF investors are also adjusted downwards,” he explained.

He further added that increased financial literacy among Kenyans and volatile market conditions have made MMFs an attractive option.

Especially for conservative investors looking for liquidity and safety.

Funds Posting Sub-10% Daily Returns

With T-bill returns slipping, MMFs have begun reporting reduced yields. Based on data published on June 9, 2025, the following MMFs are now offering daily returns below 10%:

| Money Market Fund | Daily Return (%) |

|---|---|

| ICEA Money Market Fund | 9.46 |

| African Alliance Money Market Fund | 7.6 |

| African Alliance Enhanced MMF | 8.17 |

| CIC Money Market Fund | 9.49 |

| CIC Wealth Money Market Fund | 7.5 |

| CPF Money Market Fund | 8.53 |

| Mali Money Market Fund | 9.62 |

| Genghis Money Market Fund | 9.88 |

| Equity Money Market Fund | 5.3 |

| Ziidi Money Market Fund (by Safaricom) | 7.13 |

| Co-operative Bank Money Market Fund | 9.49 |

Top Performers Still Holding Strong

Despite the general drop, a few MMFs are maintaining relatively high returns—close to the 10% mark.

Notably, CIC Money Market Fund and Sanlam MMF remain among the top performers in terms of size and returns.

Meanwhile, Safaricom’s Ziidi MMF, launched in December 2024, has rapidly grown to manage over KSh 7.4 billion in assets, capturing a 2.3% market share in less than a year.

What Should Investors Do?

While the current rate dip may cause concern, experts recommend maintaining a long-term view:

Avoid panic withdrawals – MMFs still offer relatively stable returns compared to riskier investments.

Compare fund managers – Shop around for the best-performing funds with low management fees.

Diversify wisely – Consider complementary instruments such as infrastructure bonds or fixed savings accounts.

Conclusion

The decline in Treasury bill returns below 10% has impacted the earnings potential of Kenya’s leading Money Market Funds.

As yields compress, fund managers and investors alike are reassessing strategies to remain competitive and deliver value.

Despite the setback, MMFs remain a cornerstone of Kenya’s investment landscape, offering low-risk avenues for savings and short-term income.

ALSO READ:vivo V50 Lite Launches in Kenya: Blending Style and Power at an Affordable Price