A Nairobi-based lawyer is putting pressure on the Treasury to stop paying Godfrey Kiptum, the current CEO of the Insurance Regulatory Authority, who is still holding office even though his term ended earlier this year.

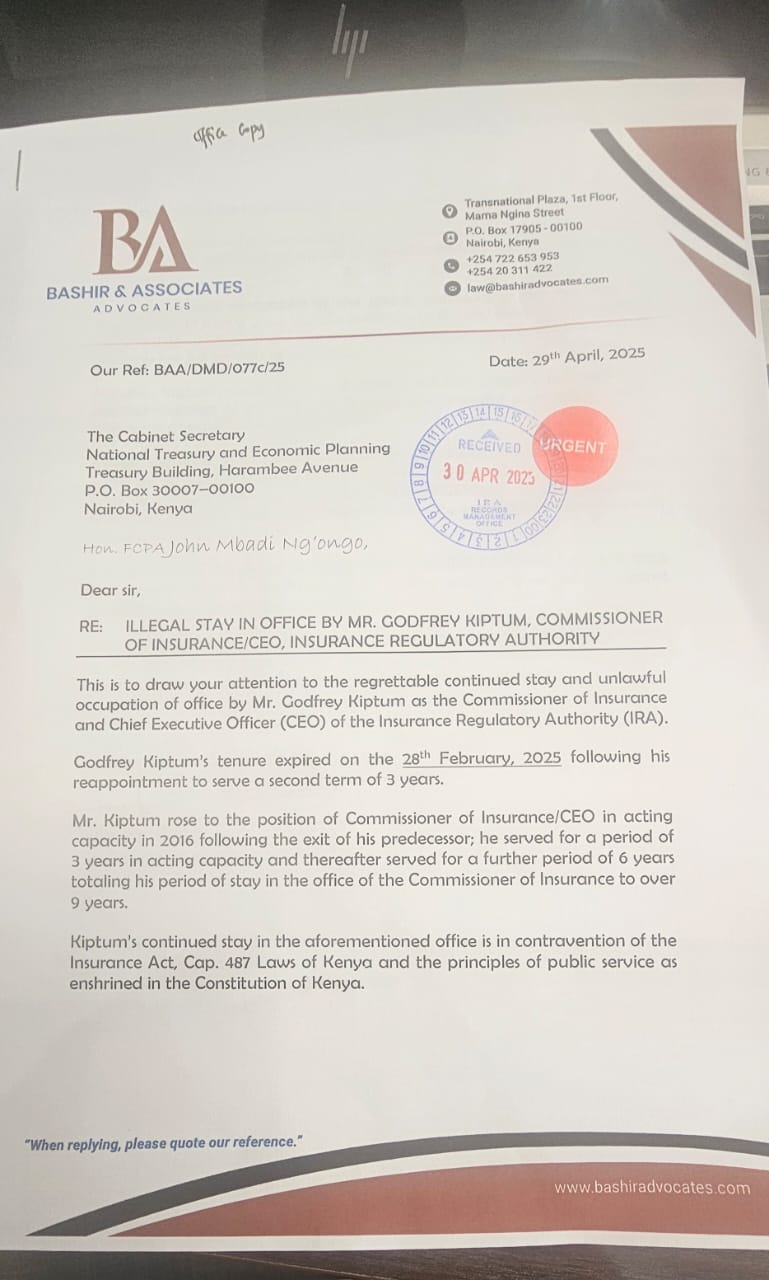

In a letter marked “urgent” and received by the Treasury on April 30, advocate Suleiman Bashir points out that Kiptum’s second and final term officially ended on February 28, 2025. Despite this, he remains in office, continues to draw a salary, and is still exercising full authority as Commissioner of Insurance.

Bashir says Kiptum has now spent more than nine years at the top of the agency. He first stepped into the role in an acting capacity in 2016, stayed in that position for three years, and was then confirmed for another three years. In 2022, he was reappointed for a second and final term, which ran until February 2025.

According to Kenya’s Insurance Act, a Commissioner is allowed two terms of three years each. That cap has already been hit.

The lawyer says Kiptum’s continued presence in the office is not only irregular but also amounts to misuse of public funds, since he is still receiving a full salary, allowances, and other executive perks despite having no legal mandate to remain in the role.

Bashir is demanding that all payments to Kiptum stop immediately and that the recruitment process to fill the role begin at once. He has given the Treasury seven days to act or face legal action, including possible suits over misuse of public resources.

But this is not just a case of someone refusing to step down quietly. Kiptum is seen by insiders as well connected. He is said to have close ties to Head of Public Service Felix Kosgey, who is also believed to be his village mate. That connection is rumored to be shielding him from being pushed out.

In 2024, Kiptum reportedly clashed with former IRA Board Chair Mwanga Mabonga, who had tried to send him on compulsory leave while an investigation into irregular dealings was ongoing. That move was swiftly overturned. Mabonga was pushed out, and Kiptum stayed put.

The letter from Bashir has been copied to key offices including the Public Service Commission, Ethics and Anti-Corruption Commission, and the IRA Board, raising the stakes for anyone turning a blind eye to the issue.

This situation is now testing whether institutions are ready to act when the law is being openly ignored, or if well-placed personal connections will once again win.