A growing number of tea farmers are speaking out against what they describe as oppressive lending practices by Greenland Fedha Limited (GFL), a microfinance institution wholly owned by the Kenya Tea Development Agency Holdings Limited (KTDA), which, though originally established to empower smallholder farmers through accessible credit, is now being accused of operating with a level of financial opacity and indifference that has left many borrowers trapped in a cycle of debt, confusion, and dwindling trust.

The complaints, which are beginning to surface in farmer forums and community channels, revolve around allegedly excessive loan charges, unexplained balances, and a lack of transparency in repayment deductions.

Green Fedha was established to enhance financial inclusion for smallholder tea farmers across the country by offering loans for development, education, farm inputs, and working capital, often collateralized through green leaf deliveries and recovered via a check-off system tied to farmers’ monthly tea earnings.

While the facility was envisioned as a tool for empowerment, some farmers now say it has become a financial trap.

One farmer who borrowed a modest sum late last year claims the debt has since swollen by nearly half its original value, despite regular monthly deductions from their tea earnings.

With nearly a year of repayment already passed, the farmer says the principal has barely reduced, raising questions about interest structures and recordkeeping.

Many now believe that Green Fedha, backed by a state-linked entity like KTDA, operates with impunity, shielded from regulatory oversight that would typically apply to commercial banks or SACCOs.

Some also argue that the dominance of Green Fedha in tea zones has edged out more farmer-friendly alternatives that offer fairer terms.

The situation is further complicated by past public announcements indicating interest rates had been reduced to 8 percent in 2021, down from a steep 21 percent, yet affected farmers claim the deductions and compounding balances reflect otherwise.

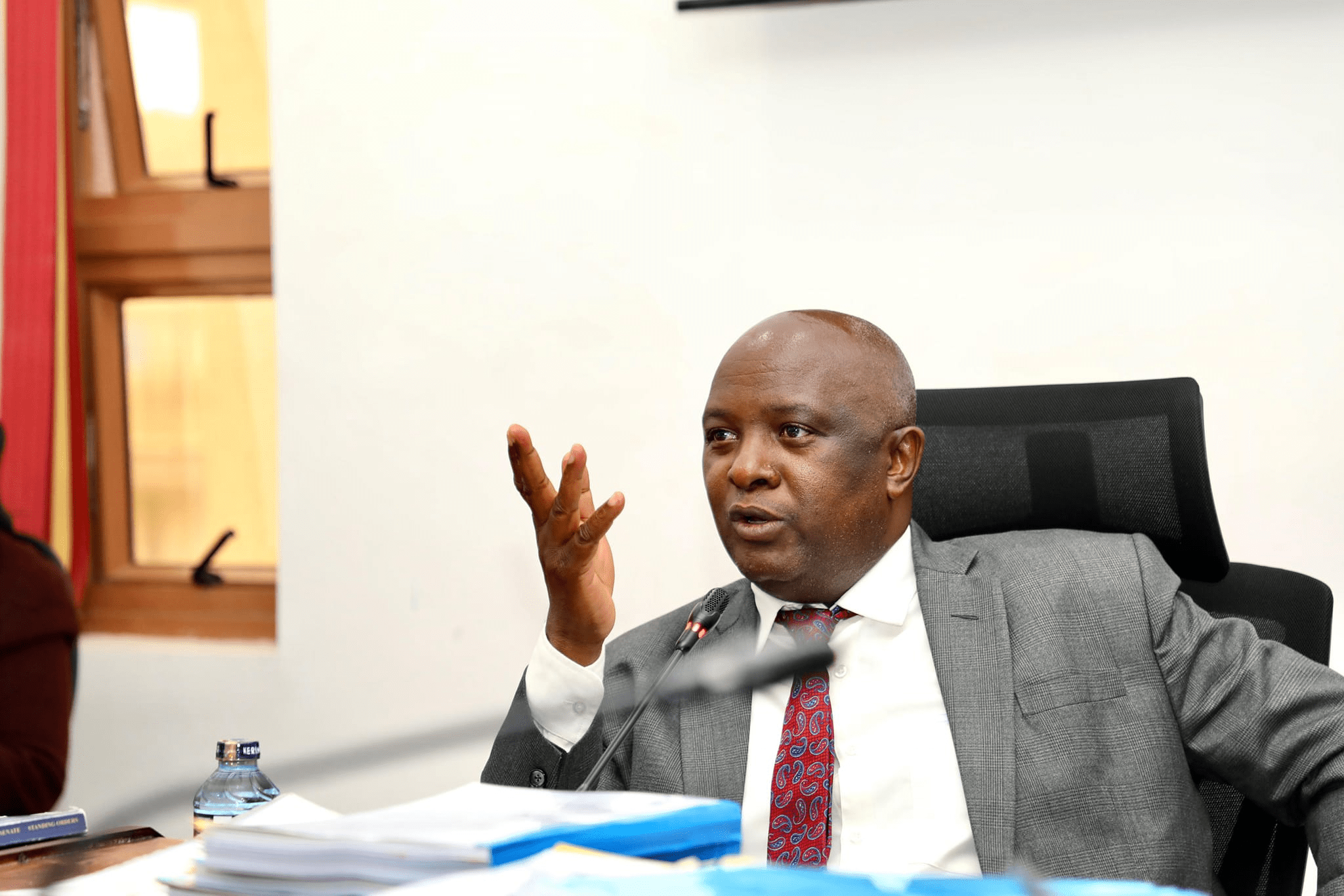

Farmers are now calling for urgent intervention by the Ministry of Agriculture and the Sacco Societies Regulatory Authority (SASRA) to audit the institution’s lending model and hold its leadership to account.

Some say the current leadership has created a closed system where accountability is nearly impossible.

This growing frustration hints at a deeper, systemic issue within tea sector finance one that could attract more scrutiny as more farmers step forward with their stories.

“Hello. Loaning companies should be next. And the first to be put under scrutiny should be Green Fedha, sponsored by KTDA. Green Fedha is a cabal of thieves run with great impunity. Their loans to tea farmers who are under KTDA are extremely punitive. Besides Green Fedha, the KTDA facility is a great hindrance to credible banks and SACCOs supporting farmers. I took a loan of 30k last year in November from the said facility. My loan currently is Kshs. 42,120. This is despite the 30% monthly deduction Green Fedha (KTDA) takes away from my monthly income from the tea I deliver. The loan is payable within two years. The first year is nearly over, and there’s 12k on top of the premium despite the monthly deductions. I think Green Fedha by KTDA should be put to task to cushion farmers from their punitive loans.”