A whistleblower has exposed the inner workings of what insiders are calling the largest financial scandal in recent years involving Equity Bank. According to exclusive information, the bank — long praised for its rapid growth and dominance in East Africa’s financial sector — is now under scrutiny over shocking internal practices that could shake public confidence.

The whistleblower, whose identity is being concealed for safety reasons, claims that top executives have been quietly overseeing questionable dealings. These include unexplained account freezes, aggressive loan recoveries, and allegations of backdoor negotiations with politically exposed individuals. The insider alleges that some customers’ funds have been moved without clear accountability, raising fears of systemic malpractice.

“If Kenyans knew half of what is happening behind closed doors, they would be alarmed,” the whistleblower said. “The public image of empowerment is very different from the reality inside.”

The allegations, if proven true, could trigger a crisis of trust in one of Kenya’s most celebrated financial institutions. Regulators are reportedly on high alert, with calls growing for an urgent independent audit.

Questionable Dealings at Equity Bank Under Close Watch

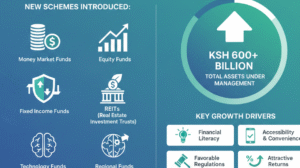

Equity Bank has long sold itself as a champion of financial inclusion. From small traders to large corporations, the bank has marketed trust, accessibility, and growth. But the new revelations suggest a widening gap between the image projected to the public and the reality within its walls.

The whistleblower paints a picture of a bank that operates by one set of rules for ordinary customers and another for the powerful and well-connected. According to the insider, senior officials have sanctioned practices that put customer funds at risk while protecting politically exposed individuals from scrutiny.

Such allegations, if confirmed, raise serious concerns about governance, transparency, and the role of regulators in safeguarding public money.

Unexplained Account Freezes Target Customers

One of the most troubling claims is that customers are facing sudden account freezes without explanation. Ordinary Kenyans, from small business owners to salaried workers, have allegedly been locked out of their funds for days or even weeks.

“These freezes happen without prior warning and often without clear legal justification,” the whistleblower said. “When customers demand answers, they are met with silence or generic responses that hide the real reasons.”

For many, such actions cripple livelihoods. A trader unable to access working capital risks losing their business. Salaried employees left without funds cannot meet basic needs. The whistleblower insists that these measures are often used as tools of control rather than genuine risk management.

Aggressive Loan Recoveries Raise Alarm

The bank is also accused of carrying out ruthless loan recovery measures. According to accounts shared, customers have been forced to sell property at throwaway prices or endure harassment from debt collection agents.

The whistleblower claims that Equity executives push for recoveries with little regard for due process. Some cases reportedly involve customers who were still negotiating repayment schedules, only to be met with threats and asset seizures.

“These recovery tactics are designed to intimidate and extract money, not to help customers restructure and recover,” the insider explained. “It is about protecting the bank’s balance sheet at all costs, even if it destroys lives.”

Financial experts warn that such practices, if unchecked, could destabilize trust in the wider banking sector, where consumer confidence is already fragile.

Dirty Deals with Politically Exposed Individuals

Perhaps the most explosive allegation involves secret backroom dealings with powerful political figures. The whistleblower claims that some executives have quietly negotiated terms that protect the wealth of politicians while punishing ordinary Kenyans.

“In certain cases, politically connected clients get preferential treatment,” the source said. “Their debts are quietly written off, or their accounts are shielded from scrutiny, while regular customers suffer harsh measures.”

This accusation fuels concerns that the bank has become entangled in Kenya’s toxic mix of politics and money. For regulators, the claims point to a systemic risk that could undermine public confidence in financial governance.

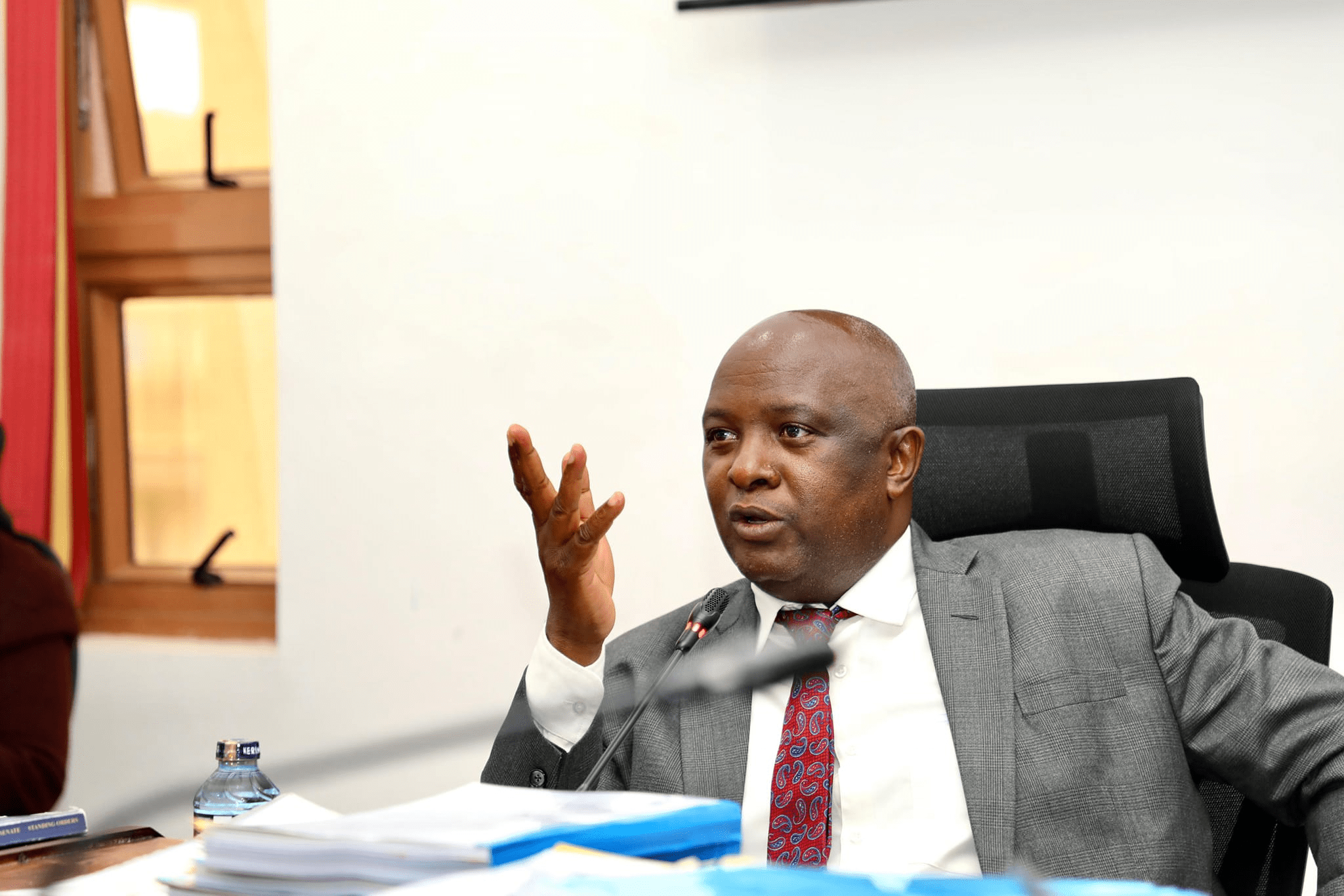

Analysts argue that if a full investigation confirms these allegations, it will not only tarnish Equity’s image but also put pressure on the Central Bank of Kenya to tighten oversight.

Public Outcry and Calls for Action

The revelations have already triggered a wave of public outrage online. Many Kenyans, who have long trusted Equity Bank with their savings, now demand accountability.

“We trusted this bank with our life savings. If this is true, it’s betrayal at the highest level,” one customer posted.

Civil society groups and financial watchdogs are now calling for urgent intervention. Some have urged Parliament to open hearings and compel top Equity executives to testify in public.

The whistleblower insists that only an independent forensic audit can reveal the depth of the rot. Until then, customers remain caught in uncertainty, unsure if their money is truly safe.