In what appears to be a calculated pattern of obstruction, evasion, and underpayment, a disgruntled transporter has exposed allegations of insurance fraud against Shari’ah-compliant risk management firm Takaful Insurance of Africa, where delays in investigation, questionable settlement offers, prolonged inaccessibility of decision-makers, and an alleged strategy of financially suffocating claimants have been cited as part of a broader scheme allegedly designed to frustrate legitimate claims and shield the company from fulfilling its contractual obligations.

The transporter, who has initiated the process of filing a formal legal complaint, narrated a series of frustrating encounters following a serious accident involving one of his tankers at the end of February, an incident which he had even documented publicly at the time.

According to the claims raised, Takaful Insurance employed various delay tactics from the outset, culminating in the deployment of an ‘investigator’ to the accident scene a full month after the incident, a move that the complainant believes was intended to frustrate the settlement process rather than expedite it.

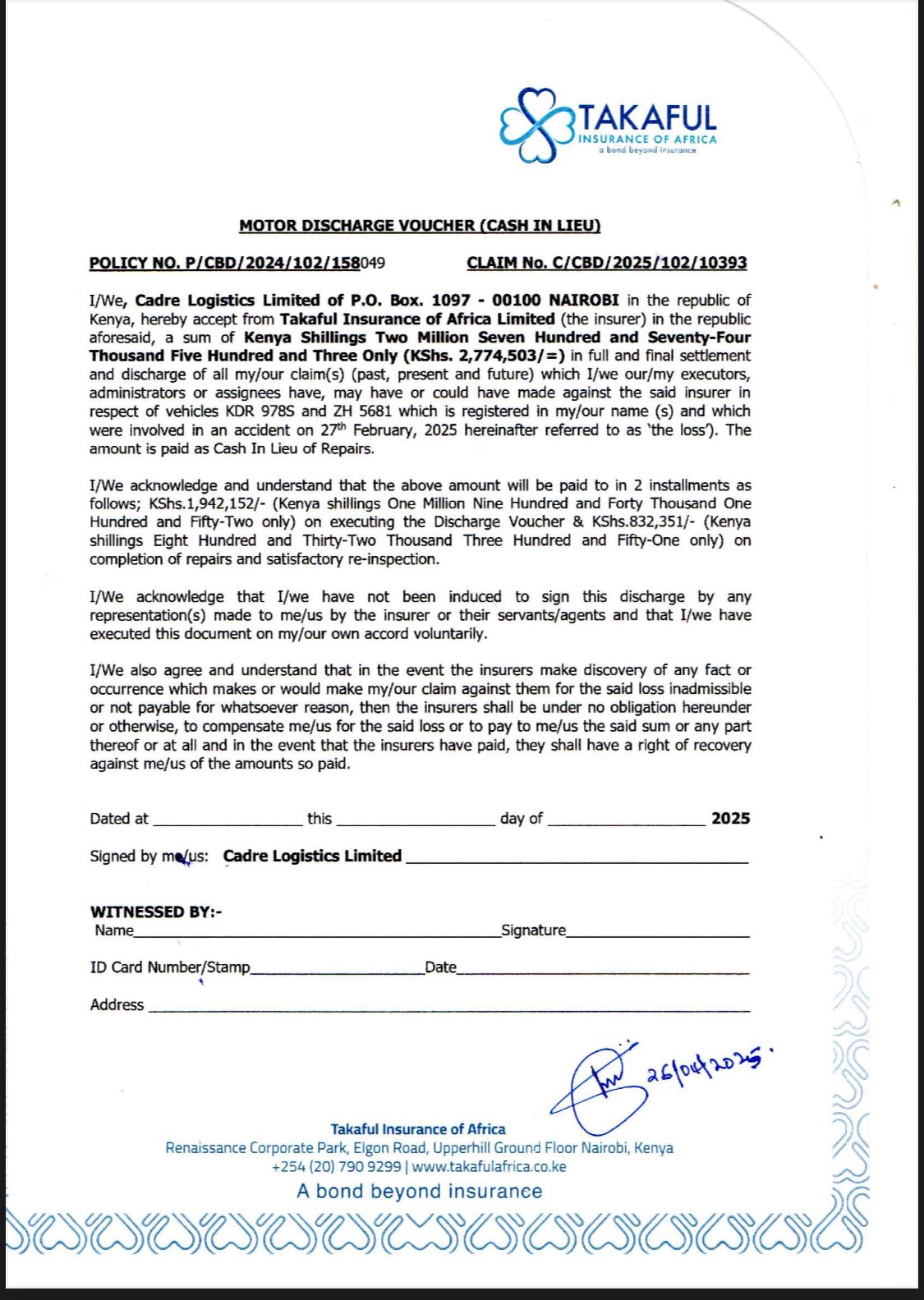

Even after repeated follow-ups, the company is said to have consistently evaded engagement, citing the unavailability of decision-makers, and ultimately issued what the transporter describes as an insulting offer of Ksh 2.9 million, despite the fact that the insured value of the vehicle was Ksh 10 million, having been assessed less than six months prior to the accident.

It is alleged that the prime mover, valued at Ksh 6.5 million and determined to be a total loss due to extensive cabin damage, and the monoblock tanker, purchased at Ksh 4.5 million and classified as extensively damaged but repairable, were both neglected in the settlement.

Since the occurrence of the accident, Takaful Insurance has reportedly not disbursed any funds, leaving the transporter to shoulder not only the substantial costs of hospital treatment for the injured driver but also the expenses related to the recovery operations which included hiring cranes, securing the accident scene for two days, and absorbing losses from spoiled product.

The resulting business disruption has allegedly cost the transporter an estimated Ksh3 million in lost revenue.

Through conversations with other players in the transport sector, the complainant claims to have established that his experience is not isolated, with many alleging that Takaful Insurance of Africa has a systemic pattern of frustrating claims through tactics designed to evade liability.

It is against this background that the complainant has escalated the matter to the Insurance Regulatory Authority (IRA) and is now seeking to mobilise a class action suit, calling upon others who have allegedly been wronged by Takaful to come forward and demand accountability.

The victim has expressed grave doubts about obtaining redress through conventional channels, citing concerns about corruption within the regulatory and judicial systems, and has resolved to exhaust all possible avenues to recover the full value of damages and losses suffered.

“Hello Nyakundi. I hope you are well. I want to raise an issue of insurance fraud which I am filing a case against. The company is Takaful. I had a vehicle accident for one of my tankers at the end of February, which I was also publicly posting about. After using all the delay tactics, including sending a so-called investigator to the crime scene one whole month after the accident, and evading us for months, claiming that the Boss is not reachable, they decided to offer an insulting payment of 2.9M Ksh. My tanker was valued less than 6 months ago by the insurer at 10M Ksh. The prime mover, valued at 6.5M, was deemed a write-off and they could not find a repair for the cabin due to its extensive damage. The monoblock/tanker is valued at the purchase price of 4.5M. It is extensively damaged but repairable. Since the accident, Takaful has NEVER remitted anything, and has left me with the hospital costs for the driver, the hire of cranes and recovering vehicles, the cost of product loss and the cost of security for the accident scene for 2 days of the recovery operation. Because of the loss of the vehicle, we have also additionally lost business estimated at Ksh 3M. I have spoken to a few other people in the transport business and they have all told me that Takaful uses these tactics to evade payment, and evade justice. While I report them to the Insurance Regulator, I am raising this matter through you, so that other people who have been swindled by Takaful can come forward so we can raise a class action against them, and anyone who enables their fraud. I will not rest until all the damages and business loss is paid for. We should not be conned by these scammers and let them off the hook. I know that the justice system in the country is up for sale and they probably collude with agents at the regulator, but let people also share their experiences of the pain that fraudulent actors like Takaful are taking them through. I have shared the relevant document and you can reach me for any queries, which I will answer.m This is the contact of the senior person who has been dealing with our case, and swindling us. I have got contacts of others who have had to use auctioneers on Takaful to get their payment.”

Licensed in 2011, Takaful Insurance introduced a model based on Shari’ah principles, where policyholders are seen as participants pooling their contributions into a shared risk fund, with surpluses redistributed or used to reduce future premiums, depending on the operational model.

The model, structured to avoid elements forbidden under Islamic law such as interest (riba), gambling (maysir) and excessive uncertainty (gharar), initially attracted admiration among the country’s Muslim population.

Operating under hybrid models combining Wakalah (agency) and Mudharabah (profit-sharing) frameworks, Takaful Insurance was presented as an ethical alternative to conventional insurance, with strict oversight from religious scholars to guarantee Shari’ah compliance.

It positioned itself as a pioneer not only in motor and medical insurance but also in broader family Takaful products, forming partnerships with banking institutions such as the National Bank of Kenya and DIB Bank to distribute its services.

However, allegations now surfacing paint a grim picture of a company accused of betraying the very ethical foundations upon which it was founded, with claims of deliberate sabotage of claims processes, weaponized bureaucracy, and exploitation of trust threatening to expose a scandal that could fundamentally undermine its credibility within the market it once sought to transform.