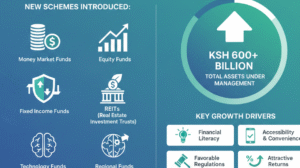

Kenya’s collective investment schemes (CIS) landscape is experiencing a remarkable period of growth and diversification.

The Capital Markets Authority (CMA) recently approved eight new investment products.

This expansion comes as the total assets under management by CIS in the country have surged past the KSh 600 billion mark.

Therefore, signaling strong investor confidence and a maturing financial market.

The introduction of these new schemes reflects a strategic effort to cater to a broader spectrum of investors.

Also, offering more tailored and innovative financial solutions.

These additions are expected to further deepen Kenya’s capital markets.

Also, providing avenues for both individual and institutional investors to participate in various asset classes and achieve their financial goals.

A Diverse Array of New Investment Opportunities

The eight new investment schemes cover a diverse range of strategies and asset allocations, including:

Money Market Funds: Continuing to be a popular choice for their liquidity and relatively stable returns, these new funds aim to offer competitive yields in the short-term market.

Equity Funds: Targeting growth-oriented investors, these schemes will focus on investing in publicly traded companies, both locally and potentially regionally, seeking capital appreciation.

Balanced Funds: Designed for investors seeking a mix of growth and income, these funds will allocate assets across equities, fixed income, and possibly other instruments to mitigate risk and optimize returns.

Fixed Income Funds: Providing exposure to government bonds, corporate bonds, and other debt instruments, these funds cater to investors prioritizing income generation and capital preservation.

Specialized Funds: Some of the new schemes are expected to target niche areas such as ethical investments (Sharia-compliant), real estate investment trusts (REITs), or technology-focused portfolios, appealing to investors with specific preferences and values.

Driving Factors Behind the KSh 600 Billion Surge

The significant growth in CIS assets, which have now exceeded KSh 600 billion.

underscores the increasing trust and participation of Kenyan investors in regulated investment products.

This surge can be attributed to several factors, including:

Increased Financial Literacy: Growing awareness and education about the benefits of pooled investments have encouraged more Kenyans to move away from traditional savings methods.

Accessibility and Convenience: CIS offer professional management, diversification, and relatively low entry barriers, making sophisticated investing accessible to everyday individuals.

Favorable Regulatory Environment: The CMA’s proactive approach to regulating and developing the capital markets has fostered a secure and transparent environment for investors.

Attractive Returns: Many CIS, particularly money market funds, have consistently delivered competitive returns, making them an appealing option for wealth creation.

Positive Economic Impact on Kenya

The expansion of investment schemes is poised to have a multifaceted positive impact on the Kenyan economy. It will:

Mobilize Domestic Savings: Channel more household and institutional savings into productive investments, fueling economic growth.

Enhance Market Liquidity: Increase trading activity in various segments of the capital markets.

Promote Financial Inclusion: Offer more diverse and accessible investment opportunities to a wider population.

Foster Innovation: Encourage fund managers to develop more sophisticated and specialized products to meet evolving investor needs.

As Kenya continues its journey towards becoming a leading financial hub in Africa, the robust growth of its collective investment schemes is a testament to the country’s economic resilience.

And the promising future of its capital markets. Investors now have an even broader array of choices to grow their wealth.

In addition to contributing to a more dynamic and inclusive financial ecosystem.

ALSO READ: UDA’s Leonard Muthende Wins Mbeere North By-Election