In a landmark move poised to enhance financial inclusion across Kenya significantly, the Association of Insurance Brokers of Kenya (AIBK) has announced a strategic partnership with Birdview Microinsurance Ltd. T

This collaboration aims to unlock the vast untapped potential of microinsurance.

Thus, bringing essential financial protection to underserved communities, particularly low-income earners, small and medium enterprises (SMEs), and Kenyans in the diaspora.

The partnership underscores a shared commitment to making insurance accessible, affordable, and relevant to a broader segment of the Kenyan population.

Indeed, this is a crucial step in boosting the nation’s overall insurance penetration, which currently lags below 3 percent.

Bridging the Protection Gap: A New Era for Microinsurance

For years, microinsurance has been identified as a critical tool for poverty alleviation and building resilience among vulnerable groups.

However, its uptake in Kenya has faced significant hurdles.

Including low awareness, perceived high costs, distrust in the industry, and a lack of tailored products for the informal sector.

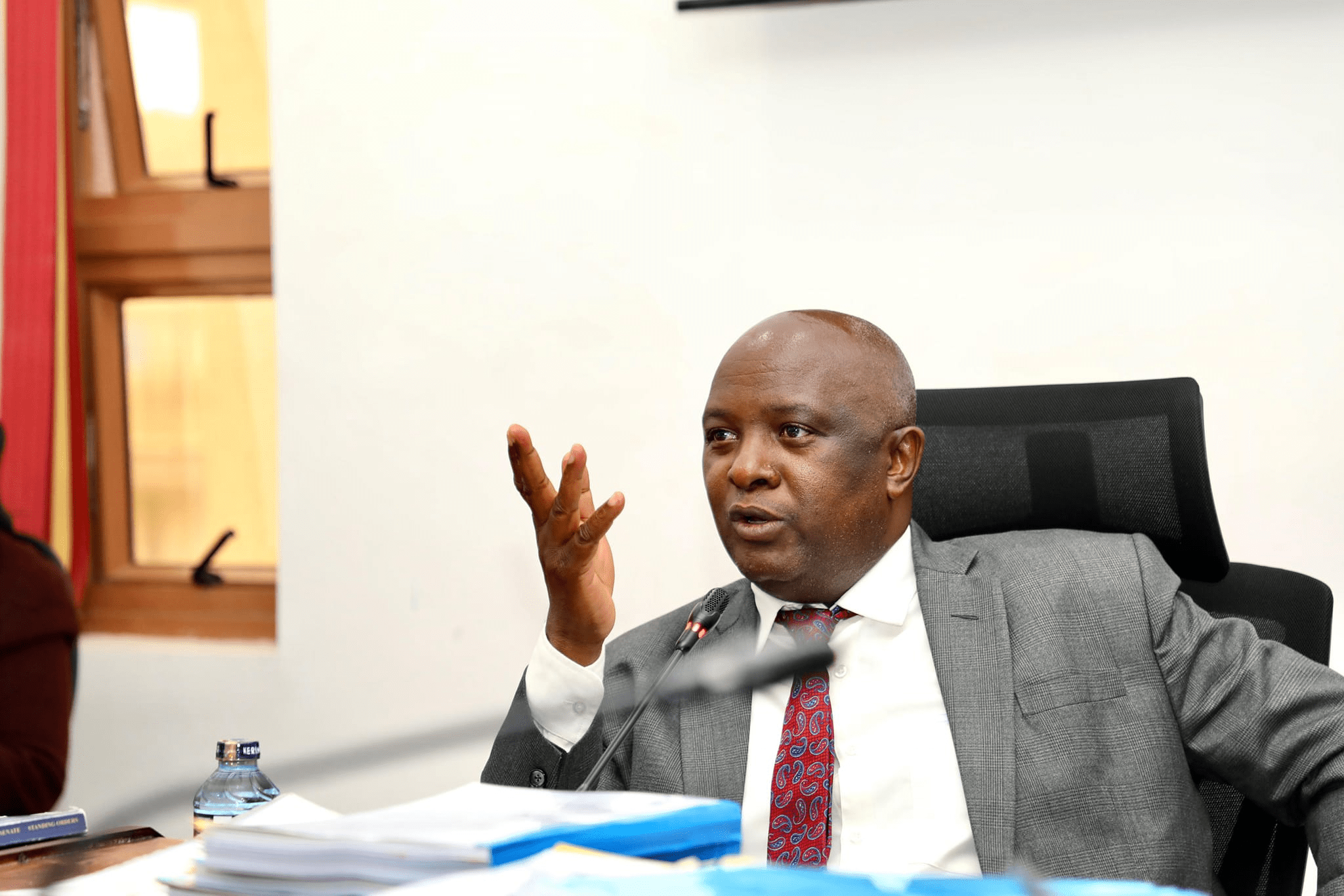

Speaking at a breakfast meeting, Mr. John K. Arap Lagat, National Chairman of AIBK, emphasized the transformative potential of this alliance.

“This partnership with Birdview Microinsurance is a significant step towards expanding access to insurance in Kenya.

By focusing on specific, often overlooked segments, we can ensure that more Kenyans have access to essential financial protection, fostering greater resilience within our communities.”

Microinsurance offers small-scale, affordable insurance products designed to mitigate specific perils for low-income individuals and small businesses.

These typically include coverage for health emergencies, last expenses, personal accidents, and even specialized services like evacuation and repatriation.

The goal is to provide a safety net that prevents families from being pushed deeper into poverty by unexpected shocks.

The Role of Brokers and Technology in Reaching the Unreached

Traditionally, insurance brokers have focused on larger accounts, leaving a vast segment of the population without access to formal insurance.

The AIBK-Birdview partnership signals a deliberate shift towards leveraging the extensive network and client relationships of brokers to reach these previously excluded groups.

Mr. James Kimani, CEO and Principal Officer of Birdview Microinsurance, highlighted the pivotal role brokers will play.

“Birdview is deeply committed to restoring dignity to our clients and believes in meaningful relationships.

With a controlling share of almost 40% of the underwritten premiums, brokers still control a large portion of the market.

And we believe they have a significant part to play in advancing microinsurance.

Our aim is to build meaningful relationships and deliver impactful products, and ensure microinsurance, which remains largely underserviced in Kenya, truly flourishes.”

A key enabler of this expanded reach will be technology.

Mr. Eliud Adiedo, CEO of AIBK, further reinforced the dedication to an inclusive and technologically-driven insurance sector.

“Our partnership with Birdview Microinsurance aligns perfectly with our vision of a more accessible and relevant insurance industry.

By focusing on niche markets and leveraging technology, we can break down barriers and bring the benefits of insurance to those who need it most.

Ultimately contributing to the economic stability and growth of our nation.”

Addressing Key Challenges and Driving Financial Stability

The initiative directly addresses several critical challenges that have hindered microinsurance adoption:

- Low Awareness and Trust: Brokers, as trusted intermediaries, can bridge the information gap and build confidence among potential clients.

- Affordability: The partnership aims to develop customized, cost-effective products tailored to the financial capabilities of low-income earners.

- Accessibility: Leveraging mobile technology and widespread broker networks will simplify the process of purchasing policies and filing claims, even in remote areas.

- Product Relevance: By targeting niche markets like the informal sector and diaspora, products can be designed to genuinely meet specific needs.

This collaboration is expected to usher in a new era for microinsurance in Kenya.

Therefore, fostering innovative products and services that cater to the diverse requirements of Kenyans at home and abroad.

Ultimately, this strategic alliance between Kenyan insurance brokers and Birdview Microinsurance holds immense promise.

For a more financially secure future and sustainable economic development for all Kenyans.

ALSO READ: Moses Kuria leaves Ruto government! Is This The Start of His 2027 Presidential Bid?